The decision by the U.S.’s largest independent propane wholesaler to exit the business serves as a reminder of the challenges and risks that companies like it face. The move also highlights the fact that at least some other independent wholesalers — including the presumed buyer of NGL Energy Partners’ propane-related assets — believe that by increasing their scale and scope they can compete more effectively with their two classes of competitors: affiliates of big midstream companies and affiliates of propane retailers. In today’s RBN blog, we discuss what the latest M&A activity in the propane space reveals.

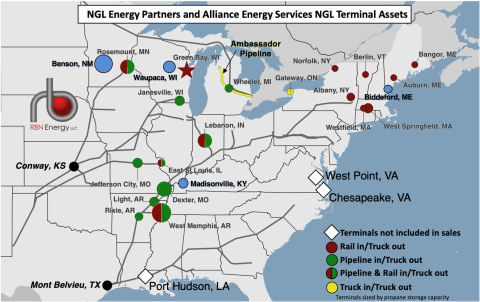

It’s not often that you see the largest player in an energy-market segment determine that it’s time to hang up its cleats. But that’s what happened when NGL Energy Partners, a master limited partnership (MLP), announced on February 10 that it was “selling substantially all of our wholesale propane business” and had reached agreements to sell 17 of its 23 NGL terminals (red, green and red/green dots in Figure 1) for $75 million and (in a separate deal) its Green Bay, WI, NGL terminal (red star) for $3.8 million. The company has said that its terminals, all but two of which are located in the eastern half of the U.S. — one is in Washington state (not shown in map) and another is in Ontario (yellow dot) — have a combined storage capacity of more than 15 million gallons and an annual throughput of more than 500 million gallons.

The recently announced sales agreements would leave NGL Energy Partners with only a handful of NGL-related assets, including three NGL terminals (Chesapeake and West Point in Virginia and Port Hudson in Louisiana; white diamonds) and the Ambassador Pipeline (yellow line), a 255-mile, 8-inch-diameter propane conduit between Marysville and Kalkaska in Michigan’s Lower Peninsula.

NGL Energy Partners did not reveal the entity or entities buying 18 of its terminals, but RBN’s understanding is that they will be purchased by Alliance Energy Services — another top-tier independent propane wholesaler. Alliance, the prospective buyer, has four NGL terminals: one each in Kentucky, Maine, Minnesota and Wisconsin (blue dots). The four Alliance terminals have more than 5 million gallons of storage capacity.

Figure 1. NGL Energy Partners and Alliance Energy Services NGL Terminal Assets. Source: RBN

Join Backstage Pass to Read Full Article