Bluewater Texas, proposed by a 50/50 joint venture (JV) of Phillips 66 (P66) and commodity trading giant Trafigura, is in a unique position in the race to construct a deepwater crude oil export facility along the U.S. Gulf Coast. Of the four marketed deepwater proposals, Bluewater is the only project in the export-centric Corpus Christi market. It is also the only one in the group that does not include an offshore platform in its scope. In today’s RBN blog, we will explore these and other differences that set Bluewater apart.

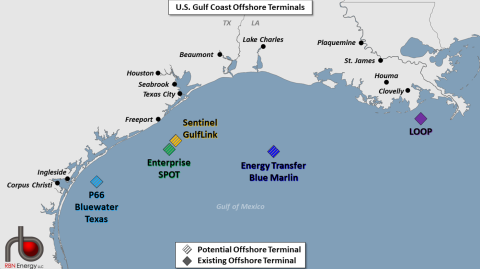

Beginning with the first blog in this series, Gulf Coast Time, we’ve discussed why we believe one or maybe two of the deepwater export projects — each capable of fully loading a 2-MMbbl Very Large Crude Carrier (VLCC) — may well proceed to construction and operation. Next, in Patience, we addressed the challenges these projects must overcome before advancing. Leader of the Pack highlighted the regulatory advantage of Enterprise Products Partners’ Sea Port Oil Terminal (SPOT) project (green striped diamond in Figure 1 below), which received its deepwater port license from the U.S. Maritime Administration (MARAD) in April. In Dark Horse, we described Sentinel Midstream’s Texas GulfLink (TGL; yellow striped diamond), which is promoting its independence, safety and environmental focus. Our most recent blog in this series, Different ’Round Here, examined Energy Transfer’s Blue Marlin project (dark-blue striped diamond), which reduces capital expenditures by utilizing existing assets.

Figure 1. Existing and Potential U.S. Gulf Coast Offshore Terminals. Source: RBN

Let’s start by introducing you to the Bluewater Texas JV partners and what they bring to the table. P66, the construction manager and operator, has deepwater port experience, including ownership and operation of the Tetney Monobuoy, a single-point mooring (SPM) buoy off the U.K.’s east coast, which has been used to import crude oil to the company’s Humber Refinery since 1971. This makes Bluewater the only one of the four potential offshore projects operated by a company with existing deepwater port operations. Trafigura, the project’s non-operating partner, is a major crude oil trader. (Trafigura initiated the permitting process for its own deepwater port in 2018 but later canceled those plans.) According to RBN’s Crude Voyager report, Trafigura in the past year has chartered at least 40 crude oil vessels departing from the Gulf Coast. (Since many vessels don’t report the charterer, we anticipate actual loadings could be higher.) This included nine VLCCs with destinations in both Asia and Europe, of which seven have departed since December 2023. Recently, Trafigura chartered one of the three VLCCs we have tracked departing the Gulf Coast for crude oil deliveries to Lagos, Nigeria — home to the new 650-Mb/d Dangote refinery, which started up earlier this year but has not yet achieved meaningful throughput. (Read more about Nigeria’s imports of U.S. crude in Stranger In Town.)

Join Backstage Pass to Read Full Article