Corn drying in the Midwest is finally wrapping up, but farmers and grain elevators are still short of propane supplies even after emergency orders were imposed by several Midwestern governors. The shortage has contributed to a spike in propane prices and the Conway, KS market jumped above Mont Belvieu last week for the first time since February 2011. But, there is more to the story. The upper Midwest is enjoying the largest bumper crop of corn in the record books, and due to recent weather it is “wet” corn needing more drying, thus more propane. With the U.S. “bumper crop” of propane from processing shale gas flooding the market, you might wonder why there is a problem. Clearly the answer is logistics – having the barrels at the right place at the right time. And that’s the reason for more concern when we get to next year. Because one of the primary propane supply conduits to the Midwest – Cochin pipeline - goes away in early 2014. Today we start a series to look at what’s going on with Midwest propane and how that market is likely to change when Cochin is reversed and turned into a diluent pipeline.

Daily Energy Blog

Forty percent of the world’s fuel oil - the residual oil left over after extracting lighter products from crude oil - is used as bunker oil to power Ocean going vessels. Much of that fuel has relatively high sulfur content. Given that refineries sell fuel oil for less than the cost of crude – the bunkers market has traditionally been a convenient dumping ground for unwanted high sulfur residual fuel oil. New international regulations that came into force in 2012 drastically reduce the permitted sulfur content in bunkers after 2015 in the world’s populated coastal regions. Today we describe the impact the new rules could have on refiners.

With the crude to natural gas price ratio (crude in $/Bbl divided by gas in $/MMbtu) continuing in historically high territory many energy companies are looking for more opportunities to shift from producing cheap gas to producing premium-price oil. For that reason, one tight-oil play long in the background—the Tuscaloosa Marine Shale (TMS) in central Louisiana and southwestern Mississippi—is attracting new attention; particularly from drillers who think they’ve figured out how to deal with TMS’s challenging characteristics. But is TMS all its fracked up to be? Today we begin a new series on TMS with a primer on this 6.6 million-acre shale play that’s said to have seven billion barrels of oil in place deep below ground but only a stone’s throw from the pipeline networks and refineries of the Gulf Coast.

A dramatic increase in crude-by-rail shipments over the past two years as well as surging lease rates for hard to come by tank cars encouraged an 18 month backlog of new orders – even while crude shipments only represent a small fraction of total rail carloads. Changes in the crude price differentials that encouraged the growth of crude by rail have reduced both the demand for tank cars and lease rates. Today we present analysis from PLG Consulting that shows rail tank car oversupply is quite possible - barring a few "wild cards".

Last month the Energy Information Administration (EIA) debuted a new monthly report detailing oil and gas drilling productivity in six of the largest US production basins. Rather than just being an “after the fact” report telling us what happened in the past, the new report provides a forecast of oil and gas production for the current and next month out in each of the six basins. The initial report indicates that oil production will increase by roughly 60 Mb/d in these basins during November with gas production increasing by 0.4 Bcf/d. The report also highlights continued improvement in rig productivity. Today we begin a series interpreting the new drilling rig productivity data.

If you add up the numbers since the start of 2012 just under 2 MMb/d of transport capacity has been added to bring crude into the Texas Gulf Coast refining region. In the next two years (2014 and 2015) we expect another 2.1 MMb/d of crude pipeline and rail transport capacity to be added. In total that is over 4.1 MMb/d of potential incoming crude – to a region with just under 3.7 MMb/d of nameplate refining capacity. Today we begin a series describing the incoming flood of crude and preparations being made to handle it.

The oil and gas pipeline industry depends on “Pigs” (pipeline integrity gauges) to verify pipelines. They help avoid leaks, fractures and costly unscheduled service interruptions. As massive new oil and gas pipeline construction continues in the US and as existing pipelines get older the pig business is becoming more valuable. But like anything else, they aren’t perfect; and pigging experts and pipeline operators are motivated to make them better. Today we continue our analysis of the pig business with a look at what some of the movers and shakers are doing to support new demands and challenges in this booming industry.

Bakken producer wellhead netbacks now favor shipping crude to the East Coast by rail. That is because Brent crude prices are trading more than $13/Bbl above WTI and nearly $11/Bbl higher than Light Louisiana Sweet crude at the Gulf Coast (October 30, 2013). Loading data from North Dakota indicates that volumes being shipped by rail have returned to levels not seen since April although less crude is going to the Gulf Coast. Today we conclude our two part analysis of Bakken producer transport options.

With the electric power sector in many other states turning to natural gas-fired generation to replace retired coal and nuclear capacity, gas interests were understandably optimistic the same would happen in California when the plan to retire the 2,200-MW San Onofre Nuclear Generating Station (SONGS) was announced in June. But California’s aggressive efforts to promote renewable energy and combined heat and power (CHP), improve energy efficiency, and reduce greenhouse gas emissions make it likely utilities and independent power companies there will use less natural gas going forward—not more. Today in the second part of our of series on California gas demand we examine why gas use by large-scale power plants in the Golden State is likely to decline, why CHP-related gas use by commercial and industrial firms will rise, and why the state’s gas pipeline infrastructure may need beefing up.

With Brent premiums hovering close to $10/Bbl versus West Texas Intermediate (WTI) crude in the past month, the netbacks for Bakken producers shipping crude by rail to the East or West Coast are higher than they are for pipeline movements to Cushing or the Gulf Coast. Netbacks represent the crude price at the destination less transportation costs back to the wellhead. Today we show how the market destinations with the highest netbacks have reversed since July.

Supplies from the three main branches of the US condensate family are increasing faster than demand can keep up. Field condensate production from shale basins is nearing 1 MMb/d - headed to 1.6 MMb/d by 2018. Plant condensate – aka natural gasoline - will increase from just over 0.3 MMb/d in 2013 to more than 0.5 MMb/d in 2018. Because field condensates cannot be exported to overseas markets, more of this material will be refined traditionally or using a splitter – pushing out existing refinery demand for natural gasoline and creating an excess of naphtha range material. Petrochemical demand for natural gasoline has dried up in the face of cheap ethane feedstocks. Canadian demand for natural gasoline as diluent will soak up some but not the entire natural gasoline surplus. With US gasoline demand declining, the only outlet for excess naphtha and natural gasoline will be more exports (beyond Canada). Today we look at changing condensate demand patterns.

Several large deep-water terminals located strategically on Caribbean islands play an important role in the international fuel oil trade. These terminals can berth larger vessels than most Gulf Coast ports – making them ideal staging points for transshipment of ocean bound cargoes coming and going from Europe, Asia or Latin America. With its recent acquisition of the Hess East Coast terminal assets, Buckeye looks set to become a dominant player in the Caribbean terminal and storage market. Today we conclude a two-part survey of Caribbean fuel terminals.

WTI for prompt delivery closed $10.94/Bbl below Brent on Wednesday (October 23, 2013). Brent prices are disconnected from WTI and Light Louisiana Sweet because the Gulf Coast is awash with light sweet crude. West Coast crude prices on the other hand are supposed to march to a different tune – isolated from new shale and Canadian crude supplies and thus expected to continue tracking international Brent. But ANS prices on the West Coast have fallen to more than $5/Bbl below Brent in the past 2 weeks and seem to be tracking WTI. Is this just a temporary aberration or could it be signaling another step change in the road to US crude independence? Today we take a closer look at what’s going on.

The June 2013 decision by Southern California Edison (SCE) to permanently shut down its San Onofre Nuclear Generation Station (SONGS)—the largest power generator in the region—got the attention of the natural gas industry, and for good reason. Natural gas interests view gas-fired generation as the logical replacement for the now-gone 2,200 MW nuclear capacity, but many other forces are at work. In this two-part series we examine southern California’s electricity cunundrum, and how big a part natural gas is likely to play in keeping the lights and air conditioning on and the pool pumps pumping.

The two-unit, 2,200-MW SONGS facility for years was a linchpin in the region’s electric grid (see Play Me A Songs). A relatively low-cost, around-the-clock generator at a pivotal location, San Onofre provided critical voltage support—an electrical engineer’s way of saying it kept the grid on an even keel. Natural gas interests expect SONGS capacity to be replaced by gas fired generation. And gas will surely have a significant role in the electricity future of the Los Angeles Basin, San Diego, and California as a whole. But because of state policies and Federal rules, among other things, utilities and merchant power companies may well end up consuming less gas than they do now, and commercial and industrial firms may use more.

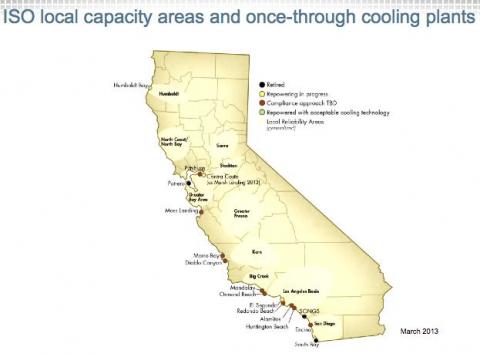

One big factor is California’s push for renewable energy and energy efficiency - including combined heat and power (CHP) plants that squeeze as much energy as possible out of each btu. Another is federal rules that will require about 3,800 MW of older gas-fired plants in southern California that use “once-through cooling” to be retired by 2020 (see Figure 1; note SONGS is just north of San Diego). Once-through cooling - like it sounds - releases cooling water after its been used only once, instead of recycling it—the preferred method now.

Figure 1

Source: California Energy Commission (Click to Enlarge)

Another 1,200 MW of gas-fired capacity in southern California is aging, inefficient and also likely to be taken offline within a few years. Regulators, gas-plant owners and others also need to wonder, how might the gas-delivery needs of power generators be affected by plans to export LNG from the region’s ports, or plans to pipe more U.S. gas south to Mexico?

In the first half of this two-part series we consider the closure of SONGS and how state policy and federal regulations are shaping natural gas’s future role in the southernmost third of the Golden State. In the second half, we will examine in more detail where gas demand is headed in California—and why—and what that means for gas producers with access to that market.

SCE decided in June it no longer made economic sense to hold out hope that SONGS units 2 and 3 could be restarted any time soon. Both units--which are co-owned by SCE (78.2%), San Diego Gas & Electric (20%) and the city of Riverside (1.8%)--had been taken offline in January 2012, Unit 2 for a planned routine outage and Unit 3 when operators detected a small leak in a steam generator tube. (Unit 1 was retired in 1992.) Subsequent testing found premature wear in tubes throughout both units’ steam generators, which had been replaced in 2009-10. It looked as if it might take years for federal nuclear regulators to approve fixing and restarting the units, so SCE and the other co-owners of SONGS decided it was better to pull the plug on them and work with state regulators to plan for replacing their output and reworking parts of southern California’s transmission system to keep the grid on an even keel without the nuclear capacity. As a result the power-supply situation in the LA Basin and San Diego this past summer was dicey, with utilities worried that the loss of a key transmission line or big gas-fired unit during a heat wave could cut off power to hundreds of thousands or even millions of customers.

The Brent premium to West Texas Intermediate (WTI) on Friday (October 18, 2013) was $9.14/Bbl – indicating a new disconnect between US crude prices and international levels. Unlike last time a big Brent premium to WTI opened up in 2010 the price of Light Louisiana Sweet at the Gulf Coast is still tracking with WTI rather than following Brent. This suggests that the US Gulf Coats is long crude at the moment and that imports of Brent priced crude are not required. Today we discuss the current Gulf Coast crude market.