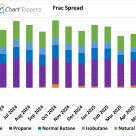

So far for June 2025, the frac spread has averaged $2.94/MMBtu—an 11% decline from May 2025 and a significant 29% drop compared to the same period last year. This marks the lowest point for the frac spread over the past 12 months, underscoring mounting pressure on natural gas liquids prices.

Analyst Insights

Analyst Insights are unique perspectives provided by RBN analysts about energy markets developments. The Insights may cover a wide range of information, such as industry trends, fundamentals, competitive landscape, or other market rumblings. These Insights are designed to be bite-size but punchy analysis so that readers can stay abreast of the most important market changes.

The Port of Corpus Christi (POCC) – the most dominant crude oil export port in the United States, responsible for more than 50% of export volumes out of the Gulf Coast (as discussed in our Crude Voyager

For the week of May 30, Baker Hughes reported that the Western Canadian gas-directed rig count remained unchanged at 43 (blue line and text in left hand chart below), 11 less than one year ago and at its lowest point this year.

Permian gas production edged lower last week, weighed down by El Paso maintenance and outages at the Puckett Compressor Station in Pecos, Texas. The compressor station was offline most of last week after an equipment failure on May 22.

As seems to be happening on an almost clocklike annual basis, wildfires are again threatening oil sands production in Alberta.

For the first time this year, the ratio of ethane to natural gas has crashed below 0.95X, signaling the prospects for ethane rejection in many parts of the country.

US oil and gas rig count declined for the fifth consecutive week, dropping to 563 for the week ending May 30 according to Baker Hughes data. The Permian (-1), Anadarko (-1) and Appalachia (-1) all lost rigs, while no basins reported gains.

Crude oil exports out of the U.S. Gulf Coast (USGC) rose for the second consecutive week, increasing by 236 Mb/d from the previous week.

The California Independent System Operator (CAISO) power grid has increasingly relied on renewable sources of generation over the last four years, aided in part by the rapid expansion of battery storage, which now regularly accounts for more than 20% of generating capacity during evening hours.

While demand for natural gas was unchanged for the week ended May 27 relative to the prior week, gas production in Appalachia surged, averaging 36.8 Bcf/d. Gas supply was especially high on Friday, when it reached a record for daily production at 37.1 Bcf/d.

According to the EIA, total U.S. propane/propylene production increased by 21 Mb/d week-on-week to 2.85 MMb/d, thereby achieving an unprecedented high—underscoring the strength of supply fundamentals and signaling continued momentum as the market enters the summer season.

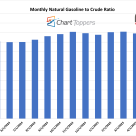

The monthly natural gasoline price for May 2025 currently stands at 90% of NYMEX crude.

Combined natural gas production of the equity partners in LNG Canada was estimated to be 2.13 Bcf/d in April 2025 (combined height of the rightmost colored bars in chart below), a small pullback from 2.24 Bcf/d estimated for March, and 0.11 Bcf/d higher than one year ago.

The ratio of NGL prices to crude oil weakened to 0.42 on Friday (green oval, right graph), a level breached only twice this year. The decline was mostly due to falling butane and propane prices, off 8% and 5% respectfully since early May.

For the week of May 23, Baker Hughes reported that the Western Canadian gas-directed rig count fell four to 43 (blue line and text in left hand chart below), 13 less than one year ago and its lowest point this year.

Infinium has begun construction on its Project Roadrunner site near Pecos, TX, which would produce up to 23,000 metric tons (MT) per year (7.6 million gallons) of sustainable aviation fuel (SAF) and other eFuel products, making it the world’s largest facility of its kind, the company said May 19.

Natural gas use in Alberta’s oil sands is approaching its typical seasonal low point near the end of May but still averaging at record levels for this time of year.

Western Canada’s propane inventories at the end of April (red circle in left hand chart below) were posted at 2.6 MMbbl, with a seasonally average increase of 0.8 MMbbl versus March and stand 0.9 MMbbl (-27%) below the five-year average (blue line) according to data from the Canada Energy Regulat

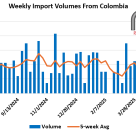

U.S. crude oil imports increased by 248 Mb/d last week, according to our Crude Oil Billboard and data from the EIA’s Weekly Petroleum Status Report.

Commonwealth LNG has passed yet another hurdle on its way to FID. Yesterday, the FERC issued the final supplemental environmental impact statement (SEIS).