U.S. Gulf Coast (USGC) crude oil exports increased last week to just over 3.56 MMb/d according to our Crude Voyager Report, driven by higher volumes out of Beaumont, Corpus Christi, and Louisiana.

Analyst Insights

Analyst Insights are unique perspectives provided by RBN analysts about energy markets developments. The Insights may cover a wide range of information, such as industry trends, fundamentals, competitive landscape, or other market rumblings. These Insights are designed to be bite-size but punchy analysis so that readers can stay abreast of the most important market changes.

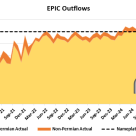

PADD 1 (East Coast) propane inventories experienced a notable drop of 441 Mbbl, bringing total stocks down to 3.8 MMbbl. This sharp weekly decline diverges significantly from typical seasonal trends.

Ksi Lisims LNG and TotalEnergies announced on May 19 that they had entered into a binding 20-year agreement for the offtake of 2 MMtpy (million tonnes per year) of LNG from the Ksi Lisims project subject to a successful final investment decision (FID) being made by Ksi Lisims.

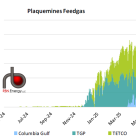

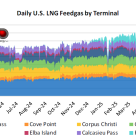

U.S. LNG feedgas demand rose by 0.24 Bdf/d last week driven by higher intake at Freeport and the new Plaquemines terminal, setting new records since it began operations.

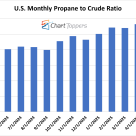

The U.S. monthly propane-to-crude ratio for May 2025 sits at 51% of NYMEX crude, down 5 percentage points from April’s monthly average of 56%. This decline marks the first notable dip in the ratio after several months of steady gains.

The Permian Highway Pipeline from West Texas to Katy underwent maintenance last month between April 22 and April 25, and Waha prices were relatively unscathed, not experiencing the extreme lows associated with previous maintenance events in the capacity-constrained Permian Basin.

Permian-to-Corpus flows have been running near full levels for over a year now, but capacity has increased recently.

The propane-to-crude ratio — a key indicator of whether the propane market is tight or soft — has been on a wild ride so far in 2025. It’s calculated by dividing the price of Mont Belvieu propane (in $/bbl) by the front-month WTI crude futures price at Cushing.

US oil and gas rig count declined for the third consecutive week, falling to 575 rigs for the week ending May 16, a decline of two rigs vs. a week ago. Rigs were added in Appalachia (+1) and All Other (+1), while the Permian (-3) and Gulf of Mexico (-1) both lost rigs.

For the week of May 16, Baker Hughes reported that the Western Canadian gas-directed rig count rose one to 47 (blue line and text in left hand chart below), 10 less than one year ago and remained within the five-year range.

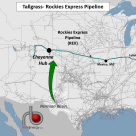

Tallgrass Energy has ambitions to build a greenfield natural gas pipeline from the Permian Basin to the Rockies Express Pipeline, the company said this week.

The Brent-WTI spread (July-versus-July contracts) narrowed once again last week, constricting to $3.33/bbl (far right of red line on chart below) - the tightest the spread has been since mid-January (excluding days of Brent expiration when price swings are commonly seen).

Gas storage in the Western Canadian province of Alberta, the region in Canada with the greatest amount of storage capacity, reached 387 Bcf as of May 13 (blue circle and text in chart below).

Crude oil exports from the U.S. Gulf Coast declined once again last week.

The EIA reported that total U.S. propane/propylene inventories had a build of 2.2 MMbbl for the week ended May 9. That was more than industry expectations for an increase of 1.7 MMbbl and the average build for the week of 1.9 MMbbl. Total U.S.

It was a challenging week for U.S. LNG feedgas demand, which slipped nearly 1 Bcf/d last week, driven by maintenance and outages.

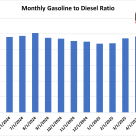

Monthly Gulf Coast gasoline prices for May 2025 have risen to 102% of diesel prices, up from 97% in April—a five-percentage-point month-over-month gain. This marks the highest gasoline-to-diesel price ratio since April 2024, indicating a notable strengthening in gasoline relative to diesel.

Today, the U.S. and China announced that they are reducing tariff rates on imports. The U.S. dropped the rate on imports of Chinese goods from 145% to 30%. China also dropped its tariff on U.S. imports from 125% to 10%.

NRG Energy will acquire a portfolio of natural gas generation facilities and a virtual power plant (VPP) platform from LS Power Equity Advisors to help it meet expected increases in power demand, the companies announced May 12.

US oil and gas rig count declined to 578 for the week ending May 9, a decline of six vs a week ago according to Baker Hughes. The Gulf of Mexico (-2), Permian (-2), Niobrara (-1) and All Other (-1) all posted declines, while no basins reported gains.