Over the past three months, spot-market prices at Henry Hub and Permian Waha have been steadily converging. As shown in the left graph below, Waha March gas traded at a mere $0.08/MMBtu (outright price), while Henry Hub fetched $4.12/MMBtu—creating a staggering basis spread of $4.04/MMBtu.

Analyst Insights

Analyst Insights are unique perspectives provided by RBN analysts about energy markets developments. The Insights may cover a wide range of information, such as industry trends, fundamentals, competitive landscape, or other market rumblings. These Insights are designed to be bite-size but punchy analysis so that readers can stay abreast of the most important market changes.

For the week of June 13, Baker Hughes reported that the Western Canadian gas-directed rig count reached 47, an increase of two (blue line and text in left hand chart below) and eight less than one year ago.

US oil and gas rig count declined for the seventh consecutive week, falling to 555 for the week ending June 13 according to Baker Hughes data. Rigs declined week-on-week in the Permian (-2), Anadarko (-1) and All Other (-1), while no basins posted gains.

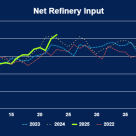

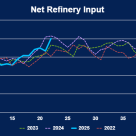

Refinery activity surged last week, with total net inputs climbing 230 Mb/d to 17.225 MMb/d, the highest level since late 2019. Gross inputs rose by 170 Mb/d, pushing utilization up nearly a full point to 94.3%, with PADDs 2 and 5 leading the gains.

Re-exports of Canadian heavy crude oil are estimated to have been 35 Mb/d in May 2025 (rightmost stacked columns in chart below), a drop of 121 Mb/d from April, 64 Mb/d less than a year ago, and an eight-month low based on tanker data compiled by Bloomberg and historical export data released by t

The EIA reported that total U.S. propane/propylene inventories had a build of 4 MMbbl for the week ended June 6, the second largest week on week increase in at least the past 10 years.

Total crude oil exports from the U.S. Gulf Coast (USGC) for the month of May dropped to 3.46 MMb/d, the lowest monthly volume since January 2023. This decline continues a broader downtrend of crude exports in the last few months.

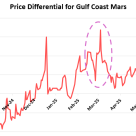

Just two weeks ago, the price differential for Mars sour crude plummeted to trade at discounts to NYMEX-CME Domestic Sweet (DSW) — the commonly quoted prompt month futures contract price of crude oil.

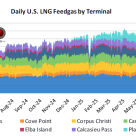

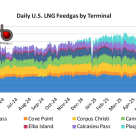

U.S. LNG feedgas demand slipped last week to its lowest level since mid-December, driven by ongoing maintenance at Sabine Pass and Cameron.

Overall outflows of natural gas from the Permian Basin were up slightly last week, with higher outflows to the West. Outflows to the West averaged 2.25 Bcf/d, up 0.08 Bcf/d week-on-week. Higher supply receipts were seen on El Paso Pipeline particularly in the back half of the week.

US oil and gas rig count fell for the sixth consecutive week, falling to 559 for the week ending June 6 according to Baker Hughes data, a decline of four vs. a week ago. Rigs were added in the Haynesville (+2), while the Permian (-3), Anadarko (-2) and Eagle Ford (-1) all posted declines.

For the week of June 6, Baker Hughes reported that the Western Canadian gas-directed rig count rose two to reach 45 (blue line and text in left hand chart below) and nine less than one year ago.

Senate Republicans should keep the 45V tax credit for clean hydrogen in place until at least 2029, and preferably longer, according to a letter signed June 5 by more than 200 companies and industry groups, including the American Petroleum Institute (API), the U.S.

Alberta’s crude oil output in April 2025 reached a record high for the month at 4.0 MMb/d (rightmost blue column and text in chart below), 0.1 MMb/d above one year ago (itself the prior record holder for April), down 0.2 MMb/d from March, and marks the seventh consecutive month of oil production

The EIA reported that total U.S. propane/propylene inventories had a build of 6.8 MMbbl for the week ended May 30.

According to the latest Weekly Petroleum Status Report released by the EIA, net refinery input surged by 670 Mb/d for the week ending May 30 to nearly 17.0 MMb/d (blue solid line below), increasing capacity utilization by 3.2% to 93.4%.

As a follow up to yesterday’s blog, Hey, Hey, What Can I Do, the ban on exports of ethane by Enterprise is already in effect. Enterprise Products Partn

U.S. LNG feedgas demand fell by 0.57 Bcf/d last week, primarily due to ongoing maintenance.