Northeast gas demand moved upward during the week ended July 15 relative to the prior week, driven by strong power demand as weather in the region was significantly hotter than the 5-year average. Overall Northeast demand averaged 19.1 Bcf/d, up 0.8 Bcf/d week-on-week.

Analyst Insights

Analyst Insights are unique perspectives provided by RBN analysts about energy markets developments. The Insights may cover a wide range of information, such as industry trends, fundamentals, competitive landscape, or other market rumblings. These Insights are designed to be bite-size but punchy analysis so that readers can stay abreast of the most important market changes.

US oil and gas rig count increased this week for the first time since April, climbing to 544 for the week ending July 18, a gain of seven vs. last week according to Baker Hughes data.

For the week of July 18, Baker Hughes reported that the Western Canadian gas-directed rig count rose two to 52 (blue line and text in left hand chart below), 14 less than one year ago and the lowest for this time of year since 2020.

According to the EIA’s most recent Weekly Petroleum Status Report, total U.S.

If you thought the AI data center boom was already wild, buckle up. Meta just took things up a notch, or five.

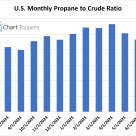

The EIA reported total U.S. propane/propylene inventories had a build of 4.4 MMbbl for the week ended July 11, which was more than industry expectations for an increase of 2.3 MMbbl and more than the average build for the week of 2.4 MMbbl.

Natural gas consumption for power generation (“power burn”) in Canada’s most populous province of Ontario is on track for a monthly record based on data compiled in RBN’s Canadian NatGas Billboard.

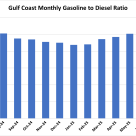

Monthly Gulf Coast gasoline prices for July 2025 dropped to 90% of diesel prices, continuing a steady slide from 94% in June and 101% in May.

Waterborne crude oil exports from the Trans Mountain Pipeline (TMP) averaged 378 Mb/d in June 2025 (rightmost stacked columns in chart below), a decline of 48 Mb/d versus May, an increase of 71 Mb/d from a year ago, and down 120 Mb/d from the peak of 498 Mb/d in March 2025 based on shipping data

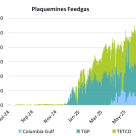

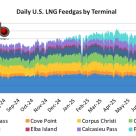

U.S. LNG feedgas demand averaged 15.58 Bcf/d last week, up 0.37 Bcf/d from the previous week, driven by rebounding flows to Cameron and Freeport. Both terminals returned to full operation after experiencing disruptions the previous week.

Re-exports of Canadian heavy crude oil are estimated to have been 117 Mb/d in June (rightmost stacked columns in chart below), a small gain of 4 Mb/d from May, 49 Mb/d less than a year ago and the third consecutive month greater than 100 Mb/d based on tanker data compiled by Bloomberg and histori

In another week-on-week decline, US oil and gas rig count fell by two for the week ending July 11, dropping total rigs to 537 according to Baker Hughes. The Anadarko (-1) and All Other (-1) both lost rigs, while no basins reported gains this week.

For the week of July 11, Baker Hughes reported that the Western Canadian gas-directed rig count rose one to 50 (blue line and text in left hand chart below), 13 less than one year ago and the lowest for this time of year since 2021.

Chevron is planning to build a $5 billion blue hydrogen and ammonia facility in Port Arthur, TX, and is pursuing funding as part of the state’s HyVelocity hydrogen hub, according to media reports.

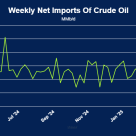

The EIA's Weekly Petroleum Status Report showed that U.S. commercial crude inventories rose sharply by 7 MMbbl last week, the largest weekly build since late January. This increase was driven primarily by a 5.8 MMbbl build in PADD 3.

During much of June and early July 2025, the AECO-Henry Hub cash basis has been trending at its lowest levels in more than two decades (chart below).

The EIA reported total U.S. propane/propylene inventories had a build of 2.7 MMbbl for the week ended July 4, falling short of industry expectations for a 2.9 MMbbl increase but exceeding the five-year average build of 2 MMbbl.

U.S. LNG feedgas demand averaged 15.2 Bcf/d last week, up 0.56 Bcf/d from the previous week, driven by higher flows to Sabine Pass and Corpus Christi.