Alberta’s crude oil output in May 2025 dropped to a two-year low at 3.6 MMb/d, 0.1 MMb/d less than a year ago and down 0.4 MMb/d from April and the largest single month drop since April 2020 (down 0.5 MMb/d) when production was curtailed in response to COVID-driven market conditions.

Analyst Insights

Analyst Insights are unique perspectives provided by RBN analysts about energy markets developments. The Insights may cover a wide range of information, such as industry trends, fundamentals, competitive landscape, or other market rumblings. These Insights are designed to be bite-size but punchy analysis so that readers can stay abreast of the most important market changes.

In recent months, the price differential of heavy, sour crude oil grades such as Canada’s Western Canadian Select (WCS) have contracted to their narrowest level in two years.

The differential between the front-month CME/NYMEX Henry Hub futures contract and the NGI daily cash price at Henry Hub has grown significantly more volatile over the past 2.5 years.

US oil and gas rig count opened the month of July with another week-on-week decline, falling to 539 for the week ending July 3, a decline of eight vs. a week ago according to Baker Hughes.

For the week of July 4, Baker Hughes reported that the Western Canadian gas-directed rig count rose three to 49 (blue line and text in left hand chart below), 11 less than one year ago and the lowest for this time of year since 2021.

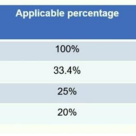

Effective July 1, 2025, oil and liquids pipelines that are regulated by the Federal Energy Regulatory Commission (FERC) and charging “index” rates will be able to increase their rates by just under 2%.

The EIA reported a second consecutive strong build, with inventories rising by 3 MMbbl—exceeding industry expectations of 2.7 MMbbl and the average build for the week of 2 MMbbl. Total U.S.

The LNG Canada consortium, the operator of the LNG Canada liquefaction plant in Kitimat, British Columbia (BC), confirmed that the LNG tanker, Gaslog Glasgow (image below), departed Kitimat on June 30 with Canada’s inaugural export cargo of LNG to overseas markets.

The budget reconciliation bill approved by the Senate on Tuesday would extend the 45V tax credit for clean hydrogen production by another two years, enough to provide a boost for projects nearing construction but still significantly shortening the credit’s eligibility window.

The Louisiana Offshore Oil Port (LOOP) is the only U.S. terminal equipped to fully load Very Large Crude Carriers (VLCCs). In June 2025, zero crude oil vessels were loaded for export out of the terminal.

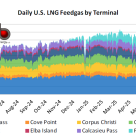

U.S. LNG feedgas demand shot up last week as Sabine Pass ramped up following maintenance, with national demand above 15 Bcf/d by the end of the week.

Outflows of natural gas from the Permian were down 0.13 Bcf/d week-on-week, with higher outflows to the West partially offset by lower outflows to the East. Outflows to the West averaged 2.41 Bcf/d, up 0.28 Bcf/d week-on-week, with higher outflows on El Paso towards the California markets.

An amendment to the Senate’s version of the budget reconciliation bill would extend the 45V tax credit for clean hydrogen production by another two years, a boost for projects nearing construction.

Combined natural gas production of the equity partners in LNG Canada was estimated to be 2.13 Bcf/d in May 2025 (combined height of the rightmost colored bars in chart below), little changed from April and a very modest increase of 0.02 Bcf/d from a year ago.

US oil and gas rig count continued its multi-month slide, with total rig count falling by seven rigs to 547 for the week ending June 27 according to Baker Hughes data. Rigs declined in the Niobrara (-3), Permian (-1), Anadarko (-1) and All Other (-2), while no basins reported gains.

For the week of June 27, Baker Hughes reported that the Western Canadian gas-directed rig count was unchanged at 46 (blue line and text in left hand chart below) and 13 less than one year ago.

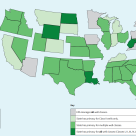

Texas moved a step closer to controlling the permitting process for the wells used in carbon capture and sequestration (CCS) when the Environmental Protection Agency (EPA) issued a proposal in June to give the state primacy over its Class VI wells.

Power-sector natural gas demand rocketed upward last week as the summer began in earnest. Extremely hot weather was felt throughout the Eastern U.S., causing Northeast gas-for-power demand to hit 13.8 Bcf/d on Sunday, the highest daily demand total since August 2024.

The EIA reported that total U.S. propane/propylene inventories had a build of 5.1 MMbbl for the week ended June 20, the largest increase for the 25th week of the year since reporting for the full country began in 2004.