U.S. propane storage is quite high. Last year's five-year high has been passed, with storage for the week ending December 9 showing more than 90 MMbbl, according to the Energy Information Administration. At this level, U.S. propane storage is 1.7 MMbbl or 2% above 2023's record highs.

Analyst Insights

Analyst Insights are unique perspectives provided by RBN analysts about energy markets developments. The Insights may cover a wide range of information, such as industry trends, fundamentals, competitive landscape, or other market rumblings. These Insights are designed to be bite-size but punchy analysis so that readers can stay abreast of the most important market changes.

U.S. crude oil exports averaged 4 MMb/d last week, an increase of 80 Mb/d from the prior week as steady Beaumont, Louisiana and Corpus Christi exports helped offset a decrease of 150 Mb/d from Houston-area terminals.

Data reported by the Canada Energy Regulator (CER) for Western Canada’s propane inventories at the end of November (red line in left hand chart below) were posted at 5.7 MMbbl, a stronger than average decline of 1.1 MMbbl and stand 0.7 MMbbl (-11%) below the five-year average (blue line).

Here’s the lowdown on U.S. LNG action last week, and boy, was it a busy one. Total feedgas demand hit 13.78 Bcf/d, up 550 MMcf/d week-on-week, thanks to solid gains at Cameron LNG, Sabine Pass, and the new kid on the block, Plaquemines LNG.

For the week ending December 20, Baker Hughes reported that the Western Canadian gas-directed rig count fell 14 to 56 (blue line in left hand chart below), nine less than one year ago and the single largest one week drop since late March 2020.

India, not China, has emerged as the leading source of growth in global oil consumption in 2024 and is expected to repeat that in 2025, according to the Energy Information Administration (EIA).

The U.S. carbon-capture industry got a boost this week when up to $3.1 billion in new funding was made available through a pair of initiatives announced by the Department of Energy.

Throughput on the Mars Oil Pipeline has rebounded from the year’s lows when storms during hurricane season disrupted E&P operations across the Gulf of Mexico (GOM), based on the latest state data.

This week, Cambridge, Massachusetts, announced it will procure 50 MW of clean energy under a virtual power plant agreement in Illinois with MN8 Energy. This is the largest virtual power plant agreement signed by a U.S.

Enbridge is holding an open season for its Express Pipeline to recontract about 100 Mb/d of transportation service originating at Hardisty, Alberta.

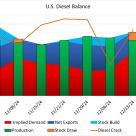

Per the EIA, diesel production fell by 135 Mb/d, while demand surged by over 1 MMb/d, leading to a reduction in inventories by 3.2 MMbbl across the U.S. last week.

The EIA reported total U.S. propane/propylene inventories had a withdrawal of 2.95 MMbbl for the week ended December 13, which was above industry expectations for a decrease of 2.175 MMbbl and above the average draw for the week of 2.75 MMbbl. Total U.S.

U.S. crude oil loadings averaged 3.7 MMb/d last week, an increase of 680 Mb/d from the previous week. Corpus Christi drove the rebound by an increase of 584 Mb/d.

On December 12, LNG Canada posted a community notification that increased flaring at its site began on December 4 and would run for a period of 60 days (i.e. to early February).

INEOS Energy has purchased the Gulf of Mexico (GOM) business of CNOOC Energy Holdings, a U.S. subsidiary of China’s CNOOC international.

The deal includes equity in Appomattox and Stampede in the GOM, and a few more mature and supporting assets.

The past week in the Permian Basin has seen outflows of natural gas move higher, taking advantage of increased outbound capacity. Outflows from the Permian Basin were up 0.16 Bcf/d week-on-week, primarily driven by higher outflows to the East.

Crude oil flows from the Permian Basin to the U.S. Gulf Coast (USGC) dropped sharply in June, falling to 5.41 MMb/d — a decline of 351 Mb/d compared to May — according to the latest monthly data from the Texas Railroad Commission.

US oil and gas rig count was unchanged at 589 for the week ending December 13 according to Baker Hughes data. Rigs were added in the Haynesville (+1) and All Other (+1), while Appalachia (-1) and Gulf of Mexico (-1) both lost rigs.

U.S. LNG exports have been buzzing with activity lately. Last week, feedgas deliveries to LNG terminals averaged 13.65 Bcf/d, with most facilities operating at or above full capacity.

The Federal Energy Regulatory Commission (FERC) decided to pump the brakes and take another look at Venture Global’s CP2 LNG project in Louisiana, along with the CP Express header pipeline. Why?