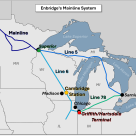

Enbridge is still cleaning up some 1,650 Bbl of crude oil that spilled from its Line 6 pipeline more than a month ago due to a faulty connection on a pump transfer pipe at a Wisconsin pump station.

Analyst Insights

Analyst Insights are unique perspectives provided by RBN analysts about energy markets developments. The Insights may cover a wide range of information, such as industry trends, fundamentals, competitive landscape, or other market rumblings. These Insights are designed to be bite-size but punchy analysis so that readers can stay abreast of the most important market changes.

For the week ending December 13, Baker Hughes reported that the Western Canadian gas-directed rig count was unchanged for a third consecutive week at 70 (blue line in left hand chart below), three more than one year ago and continuing to hold at its highest level since mid-April and near a five-y

Midwest Carbon Express, a carbon capture and sequestration (CCS) project being developed across five Midwestern states by Summit Carbon Solutions, took two important steps forward this week.

The International Energy Agency (IEA) modestly raised its growth forecast for oil demand next year in its latest report.

Chevron and ExxonMobil are exploring ways to jump into the electricity supply business to fuel energy-hungry data centers.

Chevron has completed a retrofit project at its light-crude refinery in Pasadena, Texas, that expands its flexibility for producing products, while raising its processing capacity by nearly 15% to 125 Mb/d.

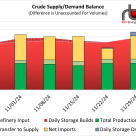

Crude oil production hit a new all-time high of 13.631 MMb/d, spurred by the EIA's re-benchmarking of supplies (see description below) by 105 Mb/d. Net refinery demand dropped by 250 Mb/d, erasing much of the previous week's 615 Mb/d rise.

The EIA reported total U.S. propane/propylene inventories had a withdrawal of 3 MMbbl for the week ended December 6, which was above industry expectations for a decrease of 2.1 MMbbl. Total U.S.

Zero re-exports of Canadian heavy crude oil from the Gulf Coast were recorded for October 2024 (black text and arrow in chart below), a pullback from a modest 84 Mb/d in September and a collapse from the record of 378 Mb/d one year ago, based on data published by the U.S. Census Bureau.

U.S. crude oil loadings averaged 2.9 MMb/d last week, a drop of 1.5 MMb/d from the previous week. Last week’s export volumes fell short of the year-to-date (YTD) average by about 979 Mb/d.

Western Canadian natural gas production experienced an upswing in the early days of December resulting in a new single day output record of 19.38 Bcf on December 6 (red text and arrow in chart below) based on data from RBN’s Canad

Shell’s Boxer pipeline and Eugene Island Pipeline System (EIPS) in the Gulf of Mexico have resumed service, according to the company.

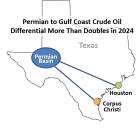

According to the latest monthly data from the Texas Railroad Commission, crude oil flows from the Permian Basin to Corpus Christi (blue line in graph below) declined to 2.36 MMb/d in July, down 26 Mb/d compared to June.

The price differential between Permian/Midland WTI crude oil and Gulf Coast WTI, represented by Magellan East Houston (MEH), has widened this year due to shrinking surplus pipeline capacity out of the Permian Basin due to rising production levels. As shown in the graph below, the differential has

State-owned Saudi Aramco has left unchanged official selling prices (OSPs) for its crudes bound for the U.S. in January 2025, halting a four month stretch of cuts. These prices are differentials to Argus Sour Crude Index (ASCI, see table below for details).

US oil and gas rig count grew by seven for the week ending December 6, the largest weekly gain since September, climbing to 589 according to Baker Hughes.

For the week ending December 6, Baker Hughes reported that the Western Canadian gas-directed rig count was unchanged at 70 (blue line in left hand chart below), four less than one year ago and holding at its highest level since mid-April.

The future of a carbon capture and sequestration (CCS) project under development in the Midwest became more uncertain this week after Wolf Carbon Solutions withdrew its petition to build a 95-mile section of a carbon dioxide (CO2) pipeline in Iowa.

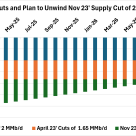

The eight OPEC+ countries—Saudi Arabia, Russia, Iraq, the United Arab Emirates, Kuwait, Kazakhstan, Algeria, and Oman—previously announced voluntary crude oil production cuts in April and November 2023.

Gibson Energy plans to conduct dredging at its Gateway Terminal (GT) in Corpus Christi, Texas, that will enable users to load 10% more volume directly onto Very Large Crude Carriers (VLCC) and Suezmax ships.