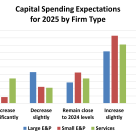

Most oil and gas executives expect their firm’s capital spending to rise in 2025 compared with 2024, although larger firms are more likely to anticipate a decrease, according to the latest Dallas Fed Energy Survey, which was published January 2.

Analyst Insights

Analyst Insights are unique perspectives provided by RBN analysts about energy markets developments. The Insights may cover a wide range of information, such as industry trends, fundamentals, competitive landscape, or other market rumblings. These Insights are designed to be bite-size but punchy analysis so that readers can stay abreast of the most important market changes.

The EIA reported total U.S. propane/propylene inventories had a withdrawal of 552 Mbbl for the week ended December 27, which was below industry expectations for a decrease of 3.23 MMbbl and below the average draw for the week of 2.3 MMbbl. Total U.S.

Since Russia began its large-scale invasion of Ukraine in February 2022, interruptions in the flow of Russian natural gas to Europe have roiled energy markets on the continent – and created new opportunities for U.S. LNG exporters.

U.S. crude oil exports averaged 4 MMb/d last week, a modest increase of 24 Mb/d from the prior week, marking the third consecutive week of stable volumes.

Permian Basin crude oil flows to Houston showed signs of recovery in July 2024, rebounding from the sharp decline in June that marked the lowest volumes since September 2023 (see blue line on the chart below), according to the latest monthly data from the Texas Railroad Commission. The dip in Jun

In many industries, the period between Christmas and the New Year can be the most boring time of the year with big decisions postponed until holidays have ended. However, it is frequently one of the most exciting weeks in natural gas trading, as we can clearly see this year.

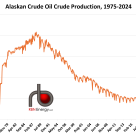

ConocoPhillips recently announced the firm got its first oil from the Nuna drill site on Alaska’s North Slope.

The EIA reported total U.S. propane/propylene inventories had a withdrawal of 4.5 MMbbl for the week ended December 20, the largest for the reporting week in the last 10 years.

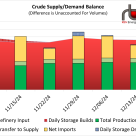

Happy holidays all. Net refinery input increased by 200 Mb/d to 16.82 MMb/d (red area in graph below), a bullish sign as refinery demand recovers much of its losses from previous weeks and nears the psychologically important 17 MMb/d threshold.

For the week ending December 27, Baker Hughes reported that the Western Canadian gas-directed rig count fell five to 51 (blue line in left hand chart below), eight less than one year ago and its lowest since early June 2023.

Crude oil production in the Lower 48 averaged 11.3 MMb/d in November (see left side of chart below), a 3% year-on-year increase, even though active rigs declined in most major producing regions, demonstrating gains in operational efficiency, the Energy Information Administration (EIA) said in its

Western Canada’s natural gas production has remained very robust during December 2024 with a new single day record being achieved on December 25 at 19.38 Bcf (red arrow, text and Santa in chart below) based on data from RBN’s Cana

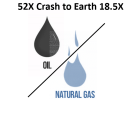

On Friday the crude-to-gas ratio – simply the price of WTI crude oil divided by the price of Henry Hub natural gas - dropped to 18.5X ($69.46/bbl WTI divided by $3.75/MMbtu Henry Hub, right graph, red dashed oval). That is down from an astronomical 52X in April when gas was $1.61 and WTI was $83.

U.S. propane storage is quite high. Last year's five-year high has been passed, with storage for the week ending December 9 showing more than 90 MMbbl, according to the Energy Information Administration. At this level, U.S. propane storage is 1.7 MMbbl or 2% above 2023's record highs.

U.S. crude oil exports averaged 4 MMb/d last week, an increase of 80 Mb/d from the prior week as steady Beaumont, Louisiana and Corpus Christi exports helped offset a decrease of 150 Mb/d from Houston-area terminals.

Data reported by the Canada Energy Regulator (CER) for Western Canada’s propane inventories at the end of November (red line in left hand chart below) were posted at 5.7 MMbbl, a stronger than average decline of 1.1 MMbbl and stand 0.7 MMbbl (-11%) below the five-year average (blue line).

Here’s the lowdown on U.S. LNG action last week, and boy, was it a busy one. Total feedgas demand hit 13.78 Bcf/d, up 550 MMcf/d week-on-week, thanks to solid gains at Cameron LNG, Sabine Pass, and the new kid on the block, Plaquemines LNG.

For the week ending December 20, Baker Hughes reported that the Western Canadian gas-directed rig count fell 14 to 56 (blue line in left hand chart below), nine less than one year ago and the single largest one week drop since late March 2020.

India, not China, has emerged as the leading source of growth in global oil consumption in 2024 and is expected to repeat that in 2025, according to the Energy Information Administration (EIA).

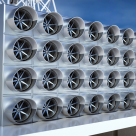

The U.S. carbon-capture industry got a boost this week when up to $3.1 billion in new funding was made available through a pair of initiatives announced by the Department of Energy.