The price differential for Bakken Light Sweet (BLS) crude oil that is shipped from North Dakota on the Pony Express Pipeline for physical delivery into Cushing, OK, has been hitting its lowest values since June/July 2020 over the past two weeks.

Analyst Insights

Analyst Insights are unique perspectives provided by RBN analysts about energy markets developments. The Insights may cover a wide range of information, such as industry trends, fundamentals, competitive landscape, or other market rumblings. These Insights are designed to be bite-size but punchy analysis so that readers can stay abreast of the most important market changes.

After wallowing at a negative 50 cents per MMBtu between March and October last year, Permian Waha natural gas prices have rebounded this year, averaging $3.11/MMbtu so far in January and spiking up to $7.52/MMBtu over the MLK holiday weekend according to NGI. As shown in the left graph below, th

An executive order issued Monday by President Trump (see Brand New Day) that directs federal agencies to pause the distribution of funds from 2021’s Infrastructure Inve

US oil and gas rig count fell to 576 for the week ending January 24, a decline of four vs. a week ago and marking the first week below 580 in four years according to Baker Hughes data.

As many energy market participants are increasingly concerned over the impact of potential tariffs between Canada and the US, data from this week underscored the importance that trade between the two countries has in the gas market.

For the week ending January 24, Baker Hughes reported that the Western Canadian gas-directed rig count fell two to 71 (blue line and text in left hand chart below), 15 less than one year ago, but still at its highest level since April.

Data reported by the Canada Energy Regulator (CER) for Western Canada’s propane inventories at the end of December (red line in left hand chart below) were posted at 4.7 MMbbl, with a seasonal average decline of 1.1 MMbbl versus November and stand 0.5 MMbbl (-10%) below the five-year average (blu

The forward price discount for Canadian heavy crude oil has been whipsawed in recent days as the threat of a 25% tariff on all exports from Canada by the newly minted Trump administration has waxed and waned.

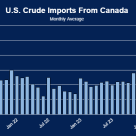

Total U.S. crude imports rose by 620 Mb/d to 6.75 MMb/d, with increases in every region except PADD 5, where volumes decreased by 100 Mb/d. PADD 2 saw an increase of 330 Mb/d to 3.1 MMb/d, enhancing the flow of Canadian supplies into the U.S.

Weather in the Northeast became much colder as a polar vortex brought a blast of icy weather on Monday and Tuesday, and cash prices in the region reacted strongly. The Northeast’s supply-demand balance was 1.4 Bcf/d tighter for the week ended January 21 compared with the week prior.

Kinder Morgan (KMI) is moving forward with the Trident Intrastate Pipeline, a $1.7 billion project designed to deliver up to 1.5 Bcf/d of natural gas from Katy, TX, just west of Houston,

The EIA reported total U.S.

U.S. crude oil exports averaged 4.6 MMb/d last week, rocketing up by 1.8 MMb/d from the prior week to the highest weekly rate since mid-November. The four-week moving average is now 3.8 MMb/d, up about 90 Mb/d from the previous week.

Combined natural gas production of the equity partners in LNG Canada reached a record 2.26 Bcf/d in November 2024 (combined height of the rightmost colored bars in chart below), a slight gain of 0.01 Bcf/d versus October and 0.4 Bcf/d higher than one year ago.

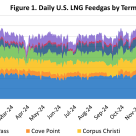

Total U.S. LNG feedgas demand averaged 14.76 Bcf/d last week, up 32 MMcf/d from the week prior, with a big jump up in intake at the new Plaquemines LNG offsetting lower inflows at Freeport.

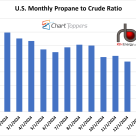

With colder weather, the price of propane is up slightly to about 47% the price of NYMEX crude. The ratio averaged less than 40% in December. This is the highest the ratio has been since September 2024 when it averaged about 50%.

In recent weeks, the price spread in the Gulf Coast region for Western Canadian Select (WCS) and Access Western Blend (AWB), two grades of Canadian heavy crude oil that are actively traded for physical delivery to refiners and exporters in the Gulf Coast region, have been hovering at their narrow

Gas intake developments at LNG Canada remain uncertain. The latest community update released by LNG Canada on January 18 indicated that it would be undertaking increased flaring on January 20 and which will occur intermittently in the follow-on four week period.

Commodity trader Trafigura and CF Industries, the world’s largest ammonia producer, have successfully completed the first shipment of ammonia with LPG on the same vessel, demonstrating the ability to transport low-carbon ammonia to ports with less demand for full ammonia shipments.

Natural gas production in the Permian Basin was relatively strong between 20.28 to 20.48 Bcf/d last week but then dropped by nearly 0.5 Bcf/d on Sunday as temperatures in the basin plummeted. Production levels dropped to 19.65 Bcf/d on Monday.