The late days of July have witnessed a significant reduction in the price differential for Mars sour crude oil that is delivered from Gulf Coast offshore platforms to Clovelly, LA, closing at the end of last week (July 25) at $(1.20)/bbl.

Analyst Insights

Analyst Insights are unique perspectives provided by RBN analysts about energy markets developments. The Insights may cover a wide range of information, such as industry trends, fundamentals, competitive landscape, or other market rumblings. These Insights are designed to be bite-size but punchy analysis so that readers can stay abreast of the most important market changes.

The EIA reported total U.S. propane/propylene inventories had a build of 1.2 MMbbl for the week ended July 25, which was less than industry expectations for an increase of 2.6 MMbbl and the average build for the week of 2 MMbbl. This was the lowest build for this week in the past 10 years.

The cash price of Western Canada’s natural gas price marker of AECO has been decimated in July 2025, despite strong natural gas pricing elsewhere in North America and LNG exports off Canada’s west coast.

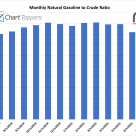

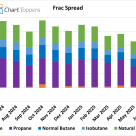

The monthly natural gasoline price for July 2025 stands at 83% of NYMEX crude. This marks a one percentage point increase from June 2025 (82%) and a three-point gain from July 2024 (80%). However, it reflects a notable six-point drop from May 2025, when the ratio reached 89%.

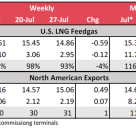

North American LNG exports in July have already pushed past June’s level and the all-time record from April is in sight.

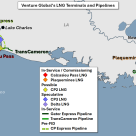

Venture Global has reached a final investment decision (FID) and secured $15.1 billion in financing for Phase 1 of its CP2 LNG project (yellow-and-gray checked diamond in map below) in Cameron Parish, LA, and the CP Express pipeline (dashed green line), the company said Monday.

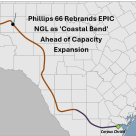

Phillips 66 has rebranded the EPIC NGL system as Coastal Bend following the completion of its acquisition earlier this year.

US oil and gas rig count declined for the week ending July 25, closing the month of July with a decrease of two rigs to 542 according to Baker Hughes data.

For the week of July 25, Baker Hughes reported that the Western Canadian gas-directed rig count rose two to 54 (blue line and text in left hand chart below), 13 less than one year ago and the lowest for this time of year since 2021.

The first export cargo at Enterprise's new Neches River ethane terminal is loading onto the Navigator Eclipse. Neches River is a new site for Enterprise's LPG/ethane exports and has a capacity of 120 Mb/d; all previous LGP/ethane exports were shipped either out of the Enterprise Hydrocar

Australia’s Fortescue said Thursday it will not proceed with its $550 million green hydrogen project in Arizona, citing changes in U.S. policy under the Trump administration.

Western Canada’s propane inventories at the end of June (red line and text in left hand chart below) were posted at 3.9 MMbbl, with a well below average build of 0.4 MMbbl versus May and stand 1.5 MMbbl (-28%) below the five-year average (blue line) according to data from the Canada Energy Regula

Mountain Valley Pipeline (MVP) began flowing gas just over a year ago following a decade-long saga involving courts, federal agencies and the U.S. Senate.

The EIA reported total U.S. propane/propylene inventories had a withdrawal of 522 Mbbl for the week ended July 18, a sharp contrast to industry expectations for an increase of 2.9 MMbbl and the average build for the week of 1.1 MMbbl.

Natural gas intake at the LNG Canada liquefaction site in Kitimat, BC has been ramping up in the past couple of months as it shifts into the mode of more regular production of LNG for export according to RBN’s Canadian

Over the past three weeks, crude oil exports out of the Gulf Coast have averaged just above 3.1 MMb/d.

Venture Global has signed a 20-year sales and purchase agreement (SPA) with Italian energy firm Eni for 2 MMtpa of LNG from CP2 Phase 1. This is Eni’s first long-term deal with a U.S. LNG terminal. It’s the third CP2 deal announced this month.

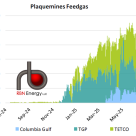

As of July 2025, the frac spread has averaged $3.29/MMBtu—a 5% increase from June 2025’s $3.14/MMBtu, but still 31% lower than the $4.77/MMBtu recorded in July 2024. Propane remains the largest single contributor at $1.37/MMBtu, followed by natural gasoline at $0.94/MMBtu.

The price differential for physical crude oil that is delivered from the heart of the Permian into Midland, TX, known as WTI Midland, has recently been trading at some of its lowest levels in more than two years.

The price spread of U.S. Gulf Coast diesel over crude oil (MEH WTI Houston) has surged over the past four weeks from $20/bbl to $32/bbl. As shown in the right graph below, this is the highest diesel spread over crude in over a year. However, the diesel vs.