Re-exports of Canadian heavy crude oil are estimated to have been 191 Mb/d in February (rightmost columns in chart below), more than double the 76 Mb/d rate of January, and 62 Mb/d less than a year ago.

Analyst Insights

Analyst Insights are unique perspectives provided by RBN analysts about energy markets developments. The Insights may cover a wide range of information, such as industry trends, fundamentals, competitive landscape, or other market rumblings. These Insights are designed to be bite-size but punchy analysis so that readers can stay abreast of the most important market changes.

Crude oil exports out of the U.S. Gulf Coast rose to nearly 4 MMb/d last week, an increase of 1.1 MMb/d, with increased activity observed in all regions except Louisiana (purple stacked area in chart below). Loaded volumes from week to week continue to see-saw.

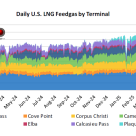

The new Plaquemines LNG terminal has got “The Right Stuff” boosting U.S. LNG feedgass, which averaged 15.2 Bcf/d last week, down slightly from the previous week.

In recent weeks, the price discount for Canadian heavy crude oil that originates from the oil storage and shipping hub of Hardisty, AB has narrowed to near a two-year high.

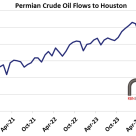

Permian Basin crude oil flows to Houston extended their recovery in October 2024, rebounding from the sharp decline in June — the lowest volume since September 2023 (see blue line on the chart below).

There was hope that the new Matterhorn pipeline from Waha to the Katy/Houston area would be a reprieve for negative natural gas prices in West Texas. After the pipe started flows in October 2024 it took a while, but by Mid November according to NGI, Waha prices were up to average $2.50/MMbtu thr

Total US rig count was unchanged for the week ending March 14 according to Baker Hughes, remaining at 592 rigs. Gains this week in the Anadarko (+2) and Bakken (+1) were offset by losses in the Permian (-3). Total US rig count is up three in the last 90 days, and down 37 vs.

For the week ending March 14, Baker Hughes reported that the Western Canadian gas-directed rig count fell four to 60 (blue line and text in left hand chart below), 19 less than one year ago and the lowest since the start of the year.

Concerns around the bankability of clean-energy projects, driven by perceived risks and regulatory uncertainty, emerged as a major theme during the annual CERAWeek conference in Houston.

Demand for natural gas in the Northeast fell last week as the weather got warmer in anticipation of the start of spring. Overall Northeast demand averaged 24.2 Bcf/d for the week ended March 11, down 3.1 Bcf/d from the prior week.

Well, here we go again. Just when it looked like the U.S. and Canada might sidestep a full-blown trade war over energy, things took another turn.

On March 10, Canada’s Whitecap Resources Inc. and Veren Inc. announced an all share based transaction valued at C$15 billion ($~10.4 billion) to merge the two companies and create Canada’s seventh largest oil and natural gas producer by production volume.

The EIA reported total U.S. propane/propylene inventories had a withdrawal of 3.4 MMbbl for the week ended March 7, which was more than industry expectations of 1.6 MMbbl and the average draw for the week of 1.2 MMbbl. This marks the highest draw for the same week in the past decade. Total U.S.

The frac spread has averaged $3.55/MMBtu so far for March 2025. This is down 19% compared to February 2025 and 35% lower year-over-year.

Total U.S. LNG feedgas demand averaged 15.22 Bcf/d last week, down 22 MMcf/d from the previous week, with small changes in intake at the terminals.

Last week, the price differential for Mars sour crude oil that is delivered from Gulf Coast offshore producing platforms via the Mars pipeline to Clovelly, LA surged to near a five-year high of $3.37/bbl on March 4th (green dashed oval in chart below).

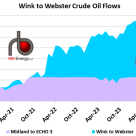

The Wink to Webster (W2W) Pipeline — the largest crude oil pipeline by volume exiting the Permian Basin — was offline for planned maintenance during the first 10 days of June 2024 to reroute a small section of the line.

The U.S. government is considering imposition of substantial fees on vessels docking in U.S. ports that are part of any fleet that includes ships built or flagged in China. This initiative is in sync with an investigation by the U.S.

After five consecutive weeks of gains, US oil and gas rig count began the month of March with a small decline, falling by one rig to 592 for the week ending March 7 according to Baker Hughes.