The U.S. government is considering imposition of substantial fees on vessels docking in U.S. ports that are part of any fleet that includes ships built or flagged in China. This initiative is in sync with an investigation by the U.S.

Analyst Insights

Analyst Insights are unique perspectives provided by RBN analysts about energy markets developments. The Insights may cover a wide range of information, such as industry trends, fundamentals, competitive landscape, or other market rumblings. These Insights are designed to be bite-size but punchy analysis so that readers can stay abreast of the most important market changes.

After five consecutive weeks of gains, US oil and gas rig count began the month of March with a small decline, falling by one rig to 592 for the week ending March 7 according to Baker Hughes.

For the week ending March 7, Baker Hughes reported that the Western Canadian gas-directed rig count fell seven to 64 (blue line and text in left hand chart below), 20 less than one year ago and the lowest since the start of the year.

It’s been a long road for Golden Pass LNG, but the Texas Gulf Coast export terminal finally got some good news this week.

The U.S. will seek up to $20 billion to refill the Strategic Petroleum Reserve (SPR), according to Energy Secretary Chris Wright. He told Bloomberg News on Friday the reserve would be filled “just close to the top.”

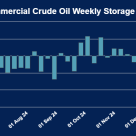

Oil prices plummeted Wednesday, March 5th as concerns over economic uncertainty, increased OPEC+ crude output, and higher than expected inventory levels pushed prices to their lowest levels in 2-3 years.

Demand for natural gas in the Northeastern U.S. averaged 27.5 Bcf/d for the week ended March 4, which was a decrease of 4.4 Bcf/d relative to the previous week. There was low demand last Wednesday and this Tuesday but higher demand over the weekend.

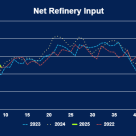

Refinery demand softened as net input fell 350Mb/d to 15.39MMb/d, with utilization down to 85.9% and PADD 1 dropping sharply. Gasoline demand surged 420Mb/d, driving a 1.43MMbbl stock draw, while distillate stocks fell as production declined and net exports rose.

Weekly exports of propane reported by the EIA were stronger than the prior reporting week at about 2.2 MMb/d, up 842 Mb/d, and above the four-week average of 1.8 MMb/d. Exports increased by 842 Mb/d to 2,248 Mb/d.

Alberta’s crude oil output in January 2025 reached a record high for the month at 4.19 MMb/d (rightmost blue column and text in chart below), soaring more than 0.38 MMb/d above one year ago (itself the prior record holder for January) and down a slight 0.07 MMb/d from the all-time high of 4.26 MM

On February 27, LNG Canada announced that it will take delivery of an LNG import cargo in early April as part of the liquefaction site’s commissioning process.

U.S. crude oil exports averaged 4.5 MMb/d last week, an increase of 694 Mb/d, with increased activity observed in all regions except Houston (dark blue stacked area in chart below), which experienced some reduced operations, likely due to fog. This marks a six-week high for U.S.

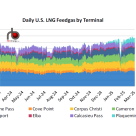

The new Plaquemines LNG terminal gave U.S. LNG feedgas the edge it needed to reach record highs in February.

Natural gasoline price for March 2025 currently stands at 92% of NYMEX crude, reflecting a significant increase since May 2024. The last time it was this high was April 2022 at 94%.

Negative Waha cash prices were a major theme of 2024, but have not been an issue for the first two months of 2025 as high flows on the new Matterhorn Express Pipeline and relatively few maintenance events have loosened constraints in the region and allowed producers to receive actual money for th

The U.S. oil and gas rig count rose by one to 593 for the week ending February 28 according to Baker Hughes, closing the month with four consecutive weeks of increases and a total gain of 11 rigs for the month.

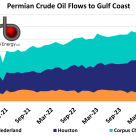

Crude oil flows from the Permian Basin to the U.S. Gulf Coast (USGC) edged up nearly 1% in September, reaching 5.69 MMb/d — a 54 Mb/d increase from August (see graph below), according to the latest monthly data from the Texas Railroad Commission.

On February 27, the price differential for Light Louisiana Sweet (LLS), a grade of light sweet crude oil that is produced in the Gulf of Mexico for delivery to the St. James, LA terminal, rose to $4.00/bbl, one if its highest values since at least 2021 (black text and arrow in chart below).

Tariffs on U.S. imports of Canadian goods of 25% are scheduled to start March 4, with energy products enjoying a reduced tariff of 10%. However, even a 10% tariff is expected to impact energy markets, and propane is no exception. As shown in the graph below, the U.S.

U.S. crude stocks took an unexpected dip last week, down 2.3 MMbbl, snapping a four-week streak of builds as refinery activity picked up. Refinery utilization climbed to 86.5%, driven by PADD 3, where gross input jumped 300 Mb/d.