US oil and gas rig count posted its largest week-on-week decline of the year, declining by seven rigs vs. a week ago to 583 for the week ending April 11 according to Baker Hughes.

Analyst Insights

Analyst Insights are unique perspectives provided by RBN analysts about energy markets developments. The Insights may cover a wide range of information, such as industry trends, fundamentals, competitive landscape, or other market rumblings. These Insights are designed to be bite-size but punchy analysis so that readers can stay abreast of the most important market changes.

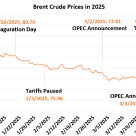

Crude oil prices often fluctuate based on the latest geopolitical tealeaves. So far in 2025, the biggest market swings come as a result of announcements by a couple of heavyweights: OPEC and President Trump. In the graph below, the orange line shows Brent prices with major events called out.

For the week ending April 11, Baker Hughes reported that the Western Canadian gas-directed rig count fell seven to 47 (blue line and text in left hand chart below), 24 less than one year ago and remains within the five-year range.

Amid concerns that funding for California’s hydrogen hub could be on the chopping block, a bipartisan group of lawmakers has asked the Department of Energy (DOE) to preserve funding for the $1.2 billion project, which they described as a “strategic investment in energy innovation.” The letter was

The Keystone Pipeline that transports Canadian heavy and light crude oil from Hardisty, AB to Cushing, OK suffered a line break at milepost 171, near Fort Ransom, ND in the morning hours of April 8.

Natural gas production in Appalachia was on a sharp upward trajectory during the early part of the Shale Era but has stalled in recent years as pipelines out of the region have become much more cumbersome to build.

Combined natural gas production of the equity partners in LNG Canada was estimated to be 2.09 Bcf/d in February (combined height of the rightmost colored bars in chart below), a modest drop from 2.20 Bcf/d recorded in January, and fractionally higher than one year ago.

Crude oil exports out of the U.S. Gulf Coast (USGC) fell once again last week, declining 463 Mb/d to 3.2 MMbbl for the week, primarily driven by a sharp decline in demand from Asia.

The EIA reported total U.S. propane/propylene inventories had a build of 1.5 MMbbl for the week ended April 4, which was more than industry expectations for an increase of 611 Mbbl and the average build for the week of 472 Mbbl. Total U.S.

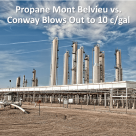

Since February, the price of propane has remained steady at roughly 54% the price of NYMEX crude. This is the highest the ratio has been since March 2022. Chilly conditions and lower storage number have kept propane strong relative to crude.

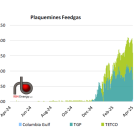

Plaquemines LNG terminal’s volumes were steady last week and the company now has an additional pipeline route available.

As expected, RRC data shows that Permian Basin crude oil flows to Houston extended their recovery in November 2024, rebounding from the sharp decline in June — the lowest volume since September 2023 (see blue line on the chart below).

Last week’s near $10/bbl meltdown in headline crude oil prices did not undermine the positive price differential for Mars sour crude oil that is delivered from Gulf Coast offshore producing platforms via the Mars pipeline to Clovelly, LA, settling at the end of last week (April 4) at $0.43/bbl.

For the first time in over a year, the price of propane in Conway, KS has dropped to more than 10 c/gal below the propane price in Mont Belvieu, TX (left chart below, green dashed circle).

US oil and gas rig count declined for the first week of the new month, declining by two to 590 rigs for the week ending April 4 according to Baker Huges data. Rigs were added in Appalachia (+1), while the Permian (-3) declined vs. last week.

For the week ending April 4, Baker Hughes reported that the Western Canadian gas-directed rig count was unchanged at 54 (blue line and text in left hand chart below), 17 less than one year ago but well within the five-year range.

Oil markets faced significant turbulence today, shaken by escalating fears of a rapidly intensifying global trade war and OPEC+'s announcement of a major supply boost set for May that's triple the previously expected volume hike.

The Department of Energy (DOE) announced today that Strategic Storage Partners, LLC has secured a $1.4 billion contract to operate and manage the Strategic Petroleum Reserve (SPR) – the world’s largest crude oil stockpile - as part of President Trump’s initiatives to support domestic supply chain

The joint venture including WhiteWater, MPLX, Enbridge and Targa reached a final investment decision (FID) today to build the Traverse Pipeline. The line will have a maximum capacity of 1.75 Bcf/d and will connect to Agua Dulce as well as the Katy area.

Well, it’s official — President Trump’s long-teased tariff shake-up is here, and while the new 10% blanket duty on all imports has everyone from Brussels to Beijing on edge, energy products have largely dodged the bullet. For now.