Crude oil exports from the Gulf Coast to the European region have been a hot topic of discussion in recent weeks.

Analyst Insights

Analyst Insights are unique perspectives provided by RBN analysts about energy markets developments. The Insights may cover a wide range of information, such as industry trends, fundamentals, competitive landscape, or other market rumblings. These Insights are designed to be bite-size but punchy analysis so that readers can stay abreast of the most important market changes.

The EIA reported total U.S. propane/propylene inventories had a build of 982 Mbbl for the week ended March 28, which was more than industry expectations for a draw of 240 Mbbl and the average draw for the week of 192 Mbbl. Total U.S.

Alberta’s crude oil output in February 2025 reached a record high for the month at 4.02 MMb/d (rightmost blue column and text in chart below), 0.06 MMb/d above one year ago (itself the prior record holder for February) and down 0.18 MMb/d from January.

A witch’s brew of factors has continued to apply pressure to Gulf Coast price differentials for Western Canadian Select (WCS) and Access Western Blend (AWB), two grades of Canadian heavy crude oil that are actively traded for physical delivery to refiners and exporters (red and blue lines in char

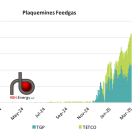

U.S. LNG exports reached another new monthly record in March, driven by ramped-up activity at Plaquemines and continued strong flows from other terminals.

Crude oil flows from the Permian Basin to the U.S. Gulf Coast (USGC) rose nearly 1% in October, reaching 5.73 MMb/d — an increase of 42 Mb/d compared to September (see graph below), according to the latest monthly data from the Texas Railroad Commission.

After running up to 35 c/gal in September 2024 from average rates of 6 c/gal over the previous five years, Gulf Coast spot terminaling rates have dropped back to the single digits.

In yet another week that saw very little movement in overall US oil and gas rig count, total rigs declined by one rig, falling to 592 for the week ending March 28 according to Baker Hughes data.

For the week ending March 28, Baker Hughes reported that the Western Canadian gas-directed rig count fell seven to 54 (blue line and text in left hand chart below), 21 less than one year ago and its second lowest point this year.

Funding for four of the seven U.S. regional hydrogen hubs could be cut amid a Department of Energy (DOE) review of the program, Reuters reported this week, as the Trump administration looks to reduce funding for clean-energy initiatives and prioritize fossil-fuel production.

Normally the start of spring signals the beginning of the shoulder season in the natural gas market, where demand dips as the weather becomes warm enough that heating demand dissipates but not hot enough that air conditioners trigger a big boost in power demand.

Today marks Opening Day for Major League Baseball in the U.S.

Total U.S. crude oil imports surged last week, climbing 810 Mb/d to 6.2 MMb/d—driven largely by a sharp rebound in Canadian volumes. Imports from Canada jumped 850 Mb/d to just under 4 MMb/d, bouncing back from the prior week’s drop to the lowest level since August 26, 2022.

Natural gas use in Alberta’s oil sands has been setting seasonal records since the start of this year, averaging 3.2 Bcf/d to date in 2025 (blue line in chart below).

The EIA reported total U.S. propane/propylene inventories had a withdrawal of 190 Mbbl for the week ended March 21, which was less than industry expectations of 1.2 MMbbl and the average draw for the week of 545 Mbbl. Total U.S.

Various ports in the U.S. Gulf Coast (USGC) continue to pursue strategies to boost market share and enhance operational efficiency, with many undergoing various long-term expansion and dredging projects to accommodate larger vessels and increase loading capabilities.

Total U.S LNG feedgas demand soared to 15.73 Bcf/d last week, up 0.51 Bcf/d from the previous week – once again driven by the newest rising star – Plaquemines LNG.

Production in the Permian Basin has grown by over 1.4 Bcf/d year-on-year supported by Matterhorn Pipeline’s startup.