Low natural gas prices are expected to fuel a revolution in US manufacturing industry over the coming years. This new industrial revolution affects not only gas and power intensive industries but downstream products produced from petrochemicals. Manufacturing industries that left the US decades ago are returning to take advantage of lower costs. Today Taylor Robinson from PLG Consulting details three phases to this industrial renaissance.

In the first episode in this series (see You Say You Want A Revolution – Shale Gas Implications for US Manufacturing) we described the growth in natural gas supplies from shale drilling and the consequent collapse in prices caused by market oversupply. Continued efficiency in drilling technology, growing supplies from gas associated with crude oil production and extremely productive wells in some parts of the Pennsylvania Marcellus play have all helped to ensure that gas supplies continue to expand. The resulting abundant gas supplies appear to be adequate to meet growing demand from industry, power generation and exports without prices increasing dramatically. Natural gas liquid (NGL) supplies also surged as drillers turned to wet gas shale – providing cheap feedstocks for the petrochemical industry. This stable outlook for low cost natural gas and NGL supplies provides the competitive environment for a revolution in US manufacturing industry that is already underway. In this episode we describe how that revolution could well play out.

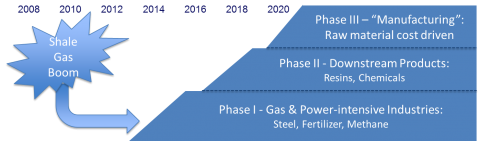

Figure 1 below illustrates the three Phases that PLG Consulting believe the shale driven manufacturing revolution will encompass. We discuss each in turn.

Figure 1; Source: PLG Consulting (click to Enlarge)

Join Backstage Pass to Read Full Article