Of the five natural gas liquids (NGLs), isobutane stands apart in its sources and markets. Isobutane comes from gas processing plants and refineries, but it is also the only NGL intentionally made from another NGL – it’s cousin, normal butane. It has a variety of exotic uses, such as aerosol propellant for everything from hair spray, to cooking sprays to shaving cream and since the early 90s as a replacement for Freon in refrigerators. A refinery process called alkylation is the largest market for isobutane, producing a high-octane gasoline blending component called alkylate. Even though it has robust markets, isobutane supply/demand balances are not immune to the growing volumes of high-BTU, “wet” shale gas and the resulting torrent of NGL production. And as gas plant isobutane volumes increase, there are changes coming to isobutane balances and the demand for merchant isomerization. Today we begin our series on isomerization by exploring what it is, why it’s valuable, and how it’s done.

Check out Kyle Cooper’s weekly view of natural gas markets at http://www.rbnenergy.com/markets/kyle-cooper |

If Normal Butane is ‘Normal’, what does that make Isobutane?

No, isobutane is not abnormal. It’s a molecular structure thing. Both normal butane and isobutane molecules have four carbon atoms and ten hydrogen atoms. But the normal butane molecule is a simple chain, while the isobutane molecule is branched. See the molecular representations in Figure #1 below.

(Click to Enlarge)

That small difference in the shape of the molecule makes a big difference in the markets for the two NGLs. Normal butane is used primarily as a low price, high RVP motor gasoline blending component. We talked about RVP and butane blending in Wasted Away in Butane Blendingville. Isobutane has the various uses described above, but mostly moves to refineries to be used as a feedstock for refinery alkylation (see Skipping the Alkylate Fandango).

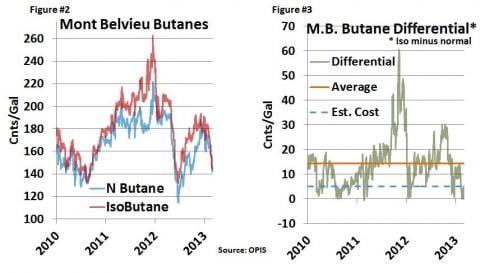

As you might have guessed, isobutane is usually (but not always) more expensive than normal butane. Figure #2 below shows the OPIS Mont Belvieu Non-TET normal butane and isobutane price from January 1, 2010 until Friday, March 8, 2013. Note that the price of the two products has fluctuated from just over $1.00/gal to more than $2.50/gal over the past two years. On Friday, OPIS indicated about $1.42/gal for normal and $1.47/gal for iso, for a differential of about a nickel. As shown in Figure #3, that differential varies widely with the relative supply/demand balances for the two products. Iso has traded from a low of about a penny under normal, to as much as 60 cnts/gal over normal. During the past three years the average differential has been 15 cnts/gal, or $6.30 per barrel for those of you who like to think in barrels. That’s a big differential from just a little kink in a molecule. So it should come as no surprise that conversion of normal butane into isobutane should be a darned good business. And for many years, it has been.

(Click to Enlarge)

It’s a Beautiful Butamer

Normal butane is converted into isobutane in a process called isomerization. How it works is another one of those well kept secrets in the mysterious NGL business. You can’t learn that much about isomerization from that usual fountain of information – Google. About all you get is that it is a chemical process that rearranges atoms to create something of greater value. And you can learn that it can be applied to all sorts of compounds, including sugars, acids, hops, and even marijuana. (Probably a lot of isomerization going on in Colorado and Washington these days, but we digress.) While the other applications of isomerization are probably very interesting and entertaining, we’ll focus only on normal butane to isobutane isomerization.

Butane isomerization happens in an isomerization (“Isom”) unit, also called a butamer unit. The butamer process converts the straight chain molecule into the branched molecule, also called the “isomer” of normal butane. The process does not convert all of the normal butane, so the butamer output goes to a deisobutanizer tower that separates the isobutane from the normal butane.

Since the primary market for isobutane is feedstock for refinery alkylation units, most butane isomerization is done inside the ‘refinery gate’. But some isomerization is done commercially, usually as part of NGL processing and fractionation. As Figure #2 indicates, the differential between normal and iso can swing widely. When it is wide, isomerization is a very lucrative business. Players with access to isomerization capacity and that understand the dynamics of both the refining and NGL markets can realize a big value uplift. But the differential can bite hard when it collapses, sometimes overnight.

Commercial isomerization units are either run on a proprietary basis whereby the operator retains the iso vs. normal uplift or on a processing fee basis. Reportedly, most of the commercial isomerization units charge a process fee between 10-12 cents/gallon. Some are more, some less, and some have old grandfathered deals at much lower rates. We understand that the average “cost” of isomerization runs about 5 cents per gallon (Figure #3, blue dashed line), which makes it a darned good business most of the time. Figure #3 demonstrates that over the course of the last three years, the price differential has been in the money for isomerization more often than not.

Isobutane Supply

The U.S. Energy Information Administration (EIA), our usually trustworthy source of NGL supply/demand statistics has a hard time with isobutane. First, they don’t count isobutane produced inside a refinery and consumed inside the same refinery. But even more frustrating, they include merchant isomerization of normal butane into isobutane with their “Natural Gas Plant Field Production” numbers. Consequently, the PADD 3 Texas Gulf Coast production statistics (location of Mont Belvieu’s big isomerization units) for normal butane average 50 Mb/d NEGATIVE, while the isobutane statistics are inflated. Sadly you can’t look at EIA numbers and see an obvious split between Gas Plant and Merchant Isomerization supply. We’ll go into more detail about why we grouse about this point in the next edition of this blog series.

Figure #4 shows total EIA isobutane supply over the past three years, increasing from about 175 Mb/d to an average of about 240 Mb/d during 2012. Over the past three years, this reported isobutane volume has been between 9% and 10% of the total NGL barrel. But note that over 100 Mb/d of that production is produced from merchant isomerization, included in EIA gas plant production statistics. When you deduct the merchant isomerization numbers, the percentage of gas plant isobutane is between 6% to 7% of the NGL barrel, a number which more closely resembles typical gas plant yields.

(Click to Enlarge)

Isobutane Demand

Fifteen to twenty percent of isobutane moves into the ‘exotic uses’ market we described above, (aerosols etc.), as a feedstock for petrochemicals like propylene oxide and isobutylene, into the octane enhancement market as isooctane, and to the export market. The balance, or 80-85% goes to make alkylate. As we saw in Skipping the Alkylate Fandango, alkylate production requires not only isobutane, but also an “olefinic” material, usually propylene. Propylene is produced as part of various refinery processes, and is also generated as an olefin cracker byproduct as we reviewed in our Let’s Get Crackin series. Olefin crackers produce less propylene when they run ethane (as many today are doing) which creates a shortfall of propylene. Consequently a number of projects to generate propylene directly from propane using a process called dehydrogenation are being developed. To understand pricing for isobutane, you’ve got to understand the relationship between isobutane, propylene and alkylate. We’ll talk more about that in the next edition of this blog series.

Isobutane production has a self-correcting mechanism whenever the alkylation market turns sour (which it does periodically when the relative prices of propylene and alkylate make isobutane less valuable). If there is too much isobutane, the merchant isomerization units simply make less. What happens is that an oversupply of isobutane causes the iso vs. normal spread to decline below some threshold (usually that nickel cost estimate mentioned above) resulting in out-of-pocket losses for merchant isomerization. The units shut down, isobutane supplies decline, and the market returns to a balanced condition. That’s a big advantage that isobutane has over the other NGLs.

The Problem with Isobutane

But there is a potential problem ahead for this orderly, self-correcting isobutane market – shale. As high-BTU, “wet” shale gas production continues to push NGL volumes from gas plants ever higher, the supply of isobutane will be increasing proportionally. The math is simple. The more gas plant production of isobutane, the less merchant isomerization will be needed. Or is that really true? Could increasing demand for alkylate combined with increasing availability of propylene from dehydrogenation absorb enough isobutane to keep the merchant isomerization units running full blast? That’s where we will go in the next installment of this series. We’ll look at the major isomerization centers, the major players, increasing exports and likely scenarios for the disposition of surplus isobutane supplies.

|

Each business day RBN Energy releases the Daily Energy Post covering some aspect of energy market dynamics. Receive the morning RBN Energy email by signing up for the RBN Energy Network. |

Comments

Alkylation olefin

Just want to correct the assumption that propylene is the major olefin used in alkylation. This is not true. Butylene (and isomers) make up nearly 85% of the US alkylation feed stocks. Technical reasons aside, butylene produces a slightly better alkylate quality.