A drum we have been beating with some regularity here at RBN is that, thanks to fast-rising production in the Eagle Ford, Permian, Marcellus/Utica and other “wet” natural gas plays, the US is awash in ethane and will become even more so. As it turns out, we now expect that “potential ethane” production will increase even more quickly than we had previously thought, to 2 MMb/d in 2016 and 2.6 MMB/d in 2019. We also believe that while the half dozen world-class steam crackers expected to come online the next few years will use some of the increased output, there will still be a lot of surplus ethane left to export—or, failing that, to reject into natural gas. In today’s blog, we provide updates on ethane production, economics and rejection, and on the potential for new ethane-consuming steam crackers and increasing ethane exports.

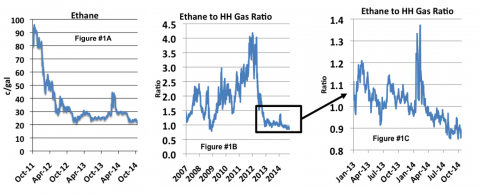

Ethane makes up the largest portion of the NGL barrel, ranging between 40% and 65% of most NGL production. It is the lightest and least valuable of the NGLs, and it has only one use (other than rejection and use as fuel). And that is as a petrochemical feedstock in an olefin “steam” cracker. If there is inadequate demand for ethane at a price that justifies its extraction from the gas stream, then it is simply left in the gas and sold for its BTU value as pipeline natural gas – a practice known as rejection. Given that ethane production over the past three years has far exceeded domestic petchem demand its price has plummeted from 2011-12 highs (and from a spike in early 2014 that came in sympathy with a big weather-related jump in propane and natural gas prices) and now hovers just above 20 cents/gal (see Figure #1A)—or when considered on a per-BTU basis, at only 85% to 90% of the per-BTU value of Henry Hub natural gas (see Figures #1B and C). [Note that we calculate this ratio each day and display the graphic results in our Spotcheck service provided as part of RBN Energy’s Backstage Pass premium service.]

Figure #1

Source: OPIS, RBN Energy (Click to Enlarge)

With ethane prices so low, operators of petchem steam crackers that can use ethane (some cannot – see What’s Crackin’ Dude)) are very happy campers, with record high margins for the production of ethylene from ethane. Ethane producers on the other hand have to carefully determine whether it is more profitable for them to extract ethane for transport and sale to downstream buyers or to reject it by leaving it in the gas stream and selling it as natural gas. The US petrochemical industry’s response to the domestic ethane surplus and the expectation of continued low US ethane prices has been to switch to ethane as their feedstock where they can (at flexible steam crackers), to retrofit less flexible crackers so they can use ethane, and – longer term, to build new ethane-based cracker capacity—including big new crackers. But ethane production is currently easily outpacing the growth in ethane consumption by these steam crackers, so a growing amount of ethane will need to be rejected—or to find another home such as exports to Canada or overseas markets.

Join Backstage Pass to Read Full Article