The prospect of decreased crude oil supplies from Mexico, the top international supplier to the U.S. Gulf Coast (USGC), is creating uncertainty among heavy crude-focused refineries. Mexico’s state-owned energy company, Petróleos Mexicanos (Pemex), instructed its trading unit to cancel up to 436 Mb/d of crude exports for April to supposedly focus on processing domestic oil at its new 340-Mb/d Dos Bocas refinery and/or its existing plants. While the refinery’s startup is likely not nearly as imminent as Pemex says, the cancellation of Mexican crude imports could be problematic for U.S. refiners with plants built to run heavy crude, a necessary ingredient to optimize operations and yields. Adding to the complexity of the situation is the upcoming startup of the Trans Mountain Pipeline expansion (TMX) and the recent reinstatement of U.S. sanctions on Venezuelan crude. In today’s RBN blog, we’ll examine the potential fallout resulting from Pemex’s decision at a time when heavy crudes elsewhere are also becoming less available.

Mexico’s energy ministry has stated that Dos Bocas will process about 179 Mb/d of crude oil this year, with plans to reach full capacity at 340 Mb/d; however, RBN’s downstream consulting practice, Refined Fuels Analytics (RFA), sees the future of Dos Bocas much differently. Previous announcements of its imminent startup have yet to result in any notable operations and we don’t see the facility reaching consistent levels of meaningful fuel output until 2026, with full ramp-up stretching to 2028. Assuming Dos Bocas does make it there (which certainly isn’t a given), our expectations are that utilization will only average about 60%. (See Here I Go Again for a detailed examination of Dos Bocas’ prospects.) There continue to be mixed signals as Pemex reversed at least 330 Mb/d of the planned cut for May, according to news reports, due to lower demand from domestic refineries.

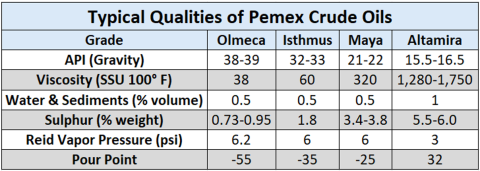

Overall, Pemex has projected domestic crude oil processing will increase from 713 Mb/d in 2023 to an average of 1.04 MMb/d in 2024, with local refineries, including Dos Bocas, aiming for 1.7 MMb/d by year-end (a prospect we think is unachievable). Let’s take a step back and delve into the various grades of Mexican crude oil. Mexico produces and exports four distinct quality grades, ranging from light to heavy:

- Olmeca, the lightest among them, boasts an API gravity of 38-39 and a sulfur content of 0.73% to 0.95% by weight, making it a valuable feedstock for lubricants and petrochemicals. Although Olmeca shares some similar product yields as Eagle Ford crude, the latter has lower sulfur content, particularly important for the naphtha cut used in gasoline production.

- Isthmus falls into the medium-heavy category, with a typical API gravity of 32-33 degrees and sulfur content of 1.8%. Isthmus yields commendable amounts of gasoline and intermediate distillates such as diesel and jet fuel.

- Maya, considered a heavy, high-sulfur grade, boasts an API gravity of 21-22 degrees and 3.4% to 3.8% sulfur. Maya produces lower yields of gasoline and diesel in simple refineries when compared to lighter crudes, necessitating high-conversion units for optimal processing.

- Altamira, the heaviest and most sour, has an API gravity of 15.5-16.5 and a sulfur content of 5.5% to 6%. Similar to Maya, Altamira yields lower gasoline and diesel in simple refining setups compared to lighter crude oils, making it suitable for asphalt production due to its physical properties.

See Figure 1 below for more details around quality for these types of crude grades. (As we noted in The Weight, crude with a higher API gravity is lighter, or less dense, while oil with a lower API gravity is heavier, or denser.)

Figure 1. Typical Qualities of Pemex Crude Oils. Source: Pemex

Join Backstage Pass to Read Full Article