The Energy Information Administration (EIA) recently raised a few eyebrows across the energy industry with a report that producers in three key shale states — including Texas, the nation’s #1 oil producer — seem to be extracting larger amounts of “heavier” crude oil. Of course, the oil is only heavier relative to the light and superlight grades that have been produced in copious amounts since the dawn of the Shale Revolution. But these denser, lower-API volumes have recently helped drive growth in total crude output. In today’s RBN blog, we unpack what the EIA discussed in its writeup, explore some of the possible drivers behind the apparently heavier oil production, and discuss what it might mean for the domestic market.

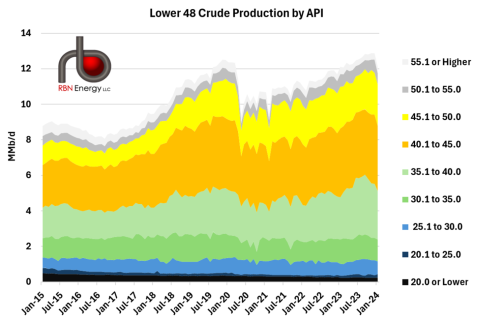

The EIA, the statistical arm of the Department of Energy (DOE), provides important data, forecasts and analysis on a national level, weaving global developments into its commentaries and outlooks. Among its regular releases is the widely tracked Weekly Petroleum Status Report (WPSR), which gives all of us a granular glimpse of U.S. crude oil balances. Investors and traders watch it very closely and respond to movements in reported supplies, demand and balances. The agency also regularly publishes a variety of more focused reports, including a January article from its Today in Energy series based on a monthly dataset of crude production by API gravity category with data back to 2015. The report highlighted a surge in the proportion of U.S. crude oil production with an API gravity between 35.1 and 40 (light-green layer in Figure 1 below). API gravity, or just API in common usage, is the primary index to specify the density of crude oil in the U.S. and much of the global market. Crude with a higher API gravity is lighter, or less dense, while oil with a lower API gravity is heavier, or denser.

Figure 1. Lower 48 U.S. Crude Oil Production by API Range. Source EIA

Join Backstage Pass to Read Full Article