One of the most anticipated and potentially impactful refinery startups in North America in years is the Dos Bocas project (officially the Olmeca Refinery), a 340 Mb/d plant under development by Mexico’s state-owned Petroleos Mexicanos (Pemex) in the southeastern state of Tabasco. The project was seen as the cornerstone of Pemex’s plans to reduce Mexico’s dependence on the U.S. for refined fuels. Construction began in 2019 with startup originally scheduled for 2022, but that timeline was never really feasible, and the Mexican government has issued multiple public statements since mid-2023 proclaiming that construction was complete and startup was imminent. However, almost a year has passed and there is no indication that any meaningful operations have occurred. So how close is Dos Bocas to startup and, more importantly, full (or close to full) production? In today’s RBN blog, we’ll provide our views on those vitally important questions.

RBN’s downstream consulting group, Refined Fuels Analytics (RFA), doesn’t see Dos Bocas reaching consistent levels of meaningful fuel output until at least 2026. It also expects full ramp-up no earlier than 2028 (see We Just Disagree), with throughput more likely plateauing at no more than 60% of the nameplate capacity (implying actual throughput of around 200 Mb/d of crude oil on a calendar-day basis). While that sounds quite pessimistic, we believe it to be realistic, taking into account the number of operating challenges which the project still has to overcome and the many years of performance issues Mexico’s refining sector has experienced.

Before we detail the specifics of our pessimism regarding Dos Bocas, let’s revisit our overall views on global refinery capacity changes. While the world saw a decades-high addition of 2 MMb/d of net refining capacity additions in 2023, largely stemming from projects that had been delayed during COVID’s heights, it didn’t make up for the lack of capacity additions and high rate of closures during the previous four years. As noted in our most recent Future of Fuels report, while we expect another solid increase of 1.1 MMb/d of capacity this year (again due to several projects that had been delayed by COVID), project activity slows down significantly in subsequent years. In fact, after accounting for planned refinery shutdowns, we expect a net addition of 1.3 MMb/d of refining capacity globally during the four years from 2025 through 2028.

This outlook for capacity additions is the lowest the RFA team has had since they began analyzing refining projects 15 years ago. In large part this decline stems from a combination of energy transition initiatives coupled with expectations that a peak in refined product demand is looming. Those factors have siphoned investment capital for traditional refining in favor of greener projects, such as renewable diesel, biofuels or other initiatives to repurpose refinery units. In addition, notable uncertainty exists with the timing, and possible eventual success, of some key projects in the short term — including Dos Bocas — while energy transition policies will figure heavily into how companies allocate capital to infrastructure in the long term. Tough-to-predict political developments and attitudes toward how climate change crosses paths with petroleum usage will figure into such project spending decisions.

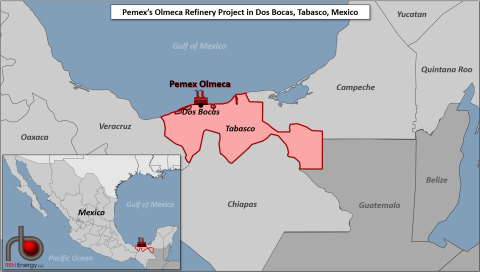

Figure. 1. The Dos Bocas Refinery in Mexico. Source: RBN

Join Backstage Pass to Read Full Article