When the price of the Tier 3 sulfur credit hit a new high of $3,600 in October 2023, the tradable sulfur credit for gasoline moved from the background to center stage in refining circles. And while credit prices have retreated slightly to about $3,400, they still represent a nearly 10-fold increase over two years and translate to a Tier 3 compliance cost of almost $3/bbl, raising concerns from refiners in a highly competitive market. In today’s RBN blog, we look at how refiners are adapting and the investments that could reduce the cost of compliance.

Implemented in 2014 with initial phase-in beginning in 2017 and full implementation in 2020, the Tier 3 gasoline sulfur standard requires that all refiners and importers that deliver gasoline to the U.S. market meet a 10 parts per million (ppm) maximum sulfur specification as an annual average, compared with 30 ppm under the previous Tier 2 specs. The Tier 3 sulfur credit system allows refiners to sell gasoline that exceeds the 10 ppm annual average as long as they match their sulfur excess with credits. We talked about how the credit system works in Part 1 of this series and looked at what’s behind the credit’s soaring price in Part 2.

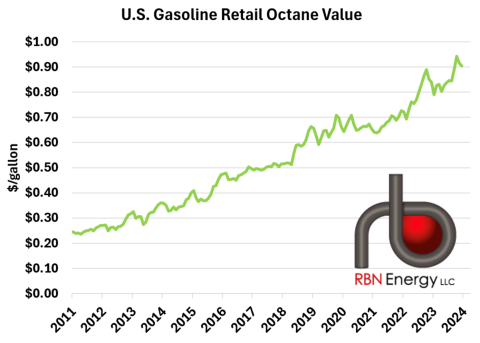

But the Tier 3 story is really about two tightly coupled gasoline quality specifications: sulfur and octane. Many U.S. refineries are unable to desulfurize gasoline down to 10 ppm without also downgrading the octane of their gasoline pool. With Tier 3 now fully in place, this has become a major new bottleneck for gasoline production in North America that is significantly reducing supply, increasing price, and affecting refining company profitability and stock prices. Octane is the primary yardstick of gasoline quality and price. Fuel consumers who pay close attention to gasoline prices know that the retail price differential between premium gasoline (typically 93 octane) and regular gasoline (typically 87 octane) — commonly known as the octane spread — has increased from a long-term historical value below $0.20/gallon to nearly $1/gallon today (green line in Figure 1). That’s because octane demand has been steadily increasing while supply has been decreasing. (For the full story on octane and the octane supply/demand picture, see Breaking The Chains.)

Figure 1. U.S. Gasoline Retail Octane Value. Source: EIA

Join Backstage Pass to Read Full Article