The price of the Tier 3 gasoline sulfur credit hit $3,600 in October, up by a factor of 10 since 2022 and roughly in line with the all-time high reached in 2019. The high price of this important credit is a direct indicator of the true cost of compliance with the Environmental Protection Agency’s (EPA) Tier 3 gasoline sulfur standard and has raised some alarm recently in refining and financial circles. In today’s RBN blog, we give some specific examples of how refiners and investment analysts are reacting.

The Tier 3 story is about two tightly coupled gasoline quality specifications: sulfur and octane. Many U.S. refineries are unable to desulfurize gasoline down to 10 parts per million (ppm) without also significantly downgrading the octane of their gasoline pool. (As we’ve noted previously, octane is the primary yardstick of gasoline quality and price.) This has become a critical new bottleneck in gasoline production in North America that is reducing gasoline supply, increasing prices and affecting refiners’ profitability. One year ago, our four-part Breaking the Chains series told the full Tier 3 story, first by explaining octane and gasoline blending (Part 1), then the octane/sulfur bottleneck (Part 2), the alternatives available to refiners (Part 3), and the sulfur credit system (Part 4).

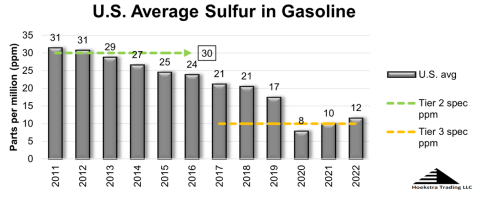

Figure 1. U.S. Average Sulfur in Gasoline in Parts Per Million. Source: EPA

Join Backstage Pass to Read Full Article