How can a business survive and thrive while spending $5.30 to make a product that sells for $1.90? That’s what’s happening in the booming renewable diesel (RD) market, where government subsidies allow RD to compete directly with petroleum diesel even though RD is inherently more costly to produce. But as new plants keep coming on stream, RD profit margins are coming under closer scrutiny. In today’s RBN blog, we analyze RD profit margins and show how they are changing as the market continues to expand.

RD is made in oil refineries using bio-feedstocks like soybean oil and used cooking oil (UCO) instead of petroleum feedstocks. In Part 1 of this series, we examined how demand for different bio-feedstocks is stressing supply chains as RD producers compete for market share. The outcome of this feedstock competition is critical for the RD sector, which operates with “upside-down economics” that allow its product to remain competitive with petroleum diesel. How exactly does that work in real life? Let’s run the numbers.

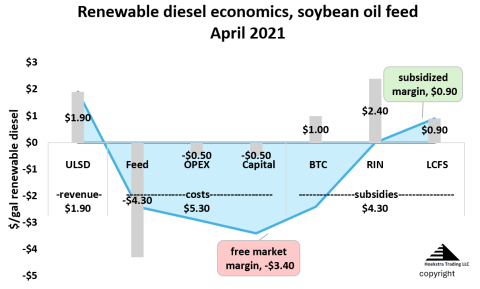

For Case 1, let’s consider a representative RD plant receiving soybean oil feedstock and making RD for sale in California in April 2021, during the early stages of the RD boom. Because it is a direct substitute, RD sells for the same price as petroleum diesel, which is commonly called ultra-low sulfur diesel (ULSD) and was selling for a wholesale price of $1.90/gal at the time. (Also note the taxes are the same for both.) To make one gallon of RD required $4.30 worth of soybean oil feedstock. The plant had operating expenses (OPEX) of $0.50/gal and bore a capital charge of $0.50/gal, putting the total cost to produce RD at $5.30/gal, counting all three factors. With a wholesale price of $1.90/gal and a production cost of $5.30/gal, the “free market margin” was minus $3.40/gal (red-shaded box in Figure 1 below). By free-market standards, the RD plant was in deep water.

Figure 1. Renewable Diesel Economics, Soybean Oil Feed, April 2021.

Sources: Hoekstra Trading LLC, RBN Energy

Join Backstage Pass to Read Full Article