The federal Renewable Identification Number (RIN) and California’s Low Carbon Fuel Standard (LCFS) have long served as tools to force renewable fuels like ethanol into the U.S. fuel supply. They are environmental credits that subsidize production of renewable fuels that would not otherwise be economically justified. Nuances embedded in the design of these credit systems have again kicked in to surprise the markets, this time with a hit to renewable diesel (RD) margins. Today’s RBN blog zeroes in on two root causes for that hit.

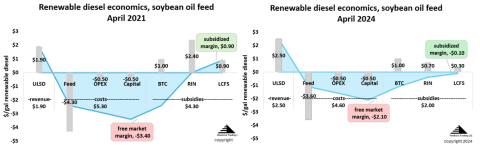

In Part 1 of this series we provided a general overview of the RD market and an update regarding two important bio-feedstocks — soybean oil and used cooking oil. In Part 2, we examined the economics of a representative plant that makes RD from soybean oil for sale in California. In that blog, we said that in our plant it cost $5.30 to make a gallon of RD that sold for $1.90, giving it a “free market margin” of minus $3.40/gal (red-shaded box in left-hand chart of Figure 1 below). That sounded like a really unattractive business. But the plant received government subsidies of $4.30/gal that brought its final margin (after subsidies) to $0.90/gal (green-shaded box in left-hand chart), quite attractive by normal investment standards.

Figure 1. Renewable Diesel Economics, Soybean Oil Feed, April 2021 and April 2024.

Sources: Hoekstra Trading LLC, RBN Energy

Join Backstage Pass to Read Full Article