Enbridge’s recent $200 million deal to buy two marine docks and land in Ingleside, TX, from Flint Hills Resources (FHR) may not be much of a surprise, as expanding its role in U.S. crude exports has been part of Enbridge’s strategy since it bought Moda Midstream’s big marine terminal next door nearly three years ago. The former Moda terminal, now known as the Enbridge Ingleside Energy Center (EIEC), can receive and partially load Very Large Crude Carriers (VLCCs) — a key reason why the facility is #1 in crude exports in the nation. In today’s RBN blog, we will take a closer look at Enbridge’s deal with FHR and how it might help grow its crude export volumes.

Let’s first do a quick overview of Enbridge’s impressive array of assets. It owns and operates the massive Mainline/Lakehead pipeline system, which transports Western Canadian crude oil to the U.S. Midwest. (Canadian regulators recently approved a new Mainline tolling program — see For Whom The Pipeline Tolls.) From the Midwest, Enbridge owns pipelines that transport crude to Eastern Canada and the Gulf Coast — these include Spearhead and Flanagan South from the Flanagan terminal in central Illinois to Cushing, OK, and a half interest in the Seaway system from Cushing to the Texas coast. The midstream giant also holds partial ownership interests in two crude oil pipelines out of the Permian: Gray Oak (68.5%) and Cactus II (30%). It also has partial ownership (27.6%) in the Bakken Pipeline System, which comprises the Dakota Access Pipeline (DAPL) and the Energy Transfer Crude Oil Pipeline (ETCOP). The network moves Bakken crude to the Midwest and Texas. Beyond pipes, it owns and operates EIEC and, through its ownership of Seaway, it has interests in the Seaway, Texas City and Seaway Freeport marine facilities. Enbridge is also building the Enbridge Houston Oil Terminal (EHOT), a Canadian-heavy focused terminal that will support additional exports through Seaway, plus blending and storage (see From Here to There to You).

EIEC really stands out, though, not just because it exports more crude than any other U.S. terminal — more than 900 Mb/d in Q1 2024 — but also because it is one of only three Gulf Coast terminals that regularly handle VLCCs. The original owner of the terminal, Occidental Petroleum, outfitted it with VLCC capabilities soon after it was built in 2016 (see Take It To The Limit), ostensibly betting that crude shipments abroad would take off rapidly after the U.S. ended its ban on most exports in late 2015. They were spot on!

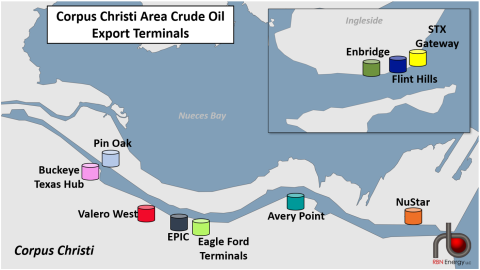

Enbridge’s other VLCC-capable asset is the Seaway Texas City complex, a joint venture with Enterprise Products Partners near Houston. It received several supertankers in 2018 but pretty much stopped the following year because of technical challenges, although it still handles smaller ships. The Gulf’s only existing offshore crude terminal, the Louisiana Offshore Oil Port (LOOP), can fully load VLCCs, while EIEC (green tank icon in Figure 1 below) and its other Ingleside neighbor — South Texas Gateway (STG; yellow tank icon), now owned by Gibson Energy — each can load VLCCs to about two-thirds of their 2-MMbbl capacity before sending them into the Gulf for topping off via reverse lightering.

Figure 1. Crude Oil Export Terminals in Corpus Christi Area. Source: RBN

Join Backstage Pass to Read Full Article