The shale gas revolution has transformed the economics of oil and gas production in the U.S. and its effects have been far reaching ,including reduced dependence on imported oil and gas supplies and strengthening domestic manufacturing through lower energy costs. Much of the credit for the technological innovation that allowed this revolution to take place is owed to the late George Mitchell (1919 – 2013) and the members of the Mitchell Energy shale gas team who persevered with the technology. Today we begin a series describing the technology and economics behind the shale drilling boom.

Motivated by the desire to tap the vast supply of hydrocarbon energy that unconventional resources now provide, George Mitchell and his team worked to refine shale technologies for more than a decade despite harsh criticism. Their dogged pursuit of the successful exploitation of unconventional hydrocarbon resources, particularly in the Barnett shale formation of northern Texas seem to exemplify the message that Calvin Coolidge delivered nearly a century ago.

“Nothing in the world can take the place of persistence. Talent will not; nothing is more common than unsuccessful men with talent. Genius will not; unrewarded genius is almost a proverb. Education will not; the world is full of educated derelicts. Persistence and determination alone are omnipotent. The slogan Press On! has solved and always will solve the problems of the human race.”

- Calvin Coolidge

The Revolution Will Not Be Televised

The revolutionary effect that shale gas technologies have had on U.S. energy market is the topic of this series of blog posts exploring the production economics of unconventional dry natural gas resources. In this series we will find that producer rates of return in the prolific shale basins are attractive – sometimes astronomical, even though the cost of drilling and completing these ‘unconventional’ wells is generally much higher than ‘conventional’ wells. In particular we will see that shale gas wells in major productive plays are often characterized by very large initial production (IP) rates, followed by a steep decline in the first two years of production and that, despite mistaken impressions, this is actually a very good thing. Specifically this combination of large initial production rates and swift declines allow producers in some of the most productive plays like the Marcellus to recoup most of their drilling costs in just a few months, leaving enough cash to go and drill more wells.

First Things First

In this first installment of the blog series we will take our first step toward understanding the economics of unconventional dry gas production by first discussing what is meant by “unconventional resources”, then reviewing the shale technologies that George and his team developed. In this series we will focus on dry gas production from a typical shale formation such as the Haynesville formation of Texas and Louisiana. The advantage of this is that being a dry gas formation it allows us to examine the economics of large shale gas wells without having to delve into the complexities associated with wet gas (including NGL) or combined crude and gas.

Where Did You Get All Those Glorious Definitions?

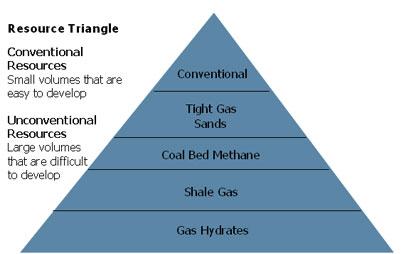

To begin our discussion let’s attempt to be somewhat precise about what we mean by conventional and unconventional resource plays. At the most simplistic level, conventional production is easier and unconventional production is harder. Conventional production is the way most oil and gas was produced decades ago. Unconventional is by far the fastest growing segment of U.S. oil and gas production today. There are as many definitions of unconventional and conventional as there are hydrocarbon websites (our own is in the following paragraphs), but the natural gas ‘Resource Triangle’ below does the best job of explaining the difference. Conventional resources are at the top of the triangle – easy to develop but increasingly harder to find. Then there are the Unconventional resources – tight sands, coal bed methane, shale gas, and gas hydrates that are more difficult to develop.

(Click Image to Enlarge) Source:Canadian Association of Petroleum Producers (CAPP)

Here Today Gone Tomorrow

Conventional oil and gas plays generally consist of individual localized geologic "traps" which are comprised of an impermeable cap rock, or seal, that captures buoyant oil and gas seeping its way up to more shallow geological regions from a “source rock” below, often a shale formation. Underneath the cap rock, the reservoir consists of medium to high permeability rock saturated with hydrocarbons. These reservoirs are such that a producer can drill a vertical well into the formation and recover economically viable volumes of hydrocarbon over a long well life. In fact the gas-in-place recovery factors for conventional reservoirs are very high, often as much as 90%. The benefits to typical onshore conventional resources plays are that most are relatively shallow, have a high recovery factor, and usually do not require sophisticated recovery techniques to make them accessible, all of which equate to a comparatively low cost of drilling and completion – at least in the early stages of a play’s development. Over the decades of natural gas production in the U.S., most of the ‘easy to find’ conventional plays have been found and exploited. The declines in natural gas production seen from the mid-1980s until the mid-2000s were directly attributable to the difficulty in finding new conventional reservoirs that could be drilled with a reasonable probability of finding economically viable gas reserves.

Join Backstage Pass to Read Full Article