A couple of weeks back in “A Market of Contradictions: Ethanol Mandates, Motor Gasoline and the Blend Wall” we looked at how US refiners are on the hook to blend more and more ethanol into a diminishing pool of gasoline (the blend wall) under Renewable Fuel Standard (RFS) legislation. Ethanol producers are losing 35 cnts/gal after the hottest July ever fried the corn harvest. Sinking ethanol production may not cover refiner’s needs. In response, refiners are turning to an arcane workaround called Renewable Identification Numbers (RINS). Today we'll peel back the red tape to see what is really going on.

Ethanol Producer Crushing Pain

Most ethanol for the RFS mandates is made using corn. Corn prices are headed through the roof right now because the coming year’s corn harvest (the harvest season runs from September 2012 until August 2013) is looking horrible after the hottest July ever. The US Department of Agriculture reports that only 31 percent of the nation’s corn crop is in good condition or better and 38 percent of the crop is in poor or worse condition. A hot and dry summer across the Midwest has placed 70 percent of the Corn Belt in extreme drought. [There are a lot of folks mad about how much corn gets diverted to ethanol (40 percent of the crop) but we’ll steer clear of that topic here.]

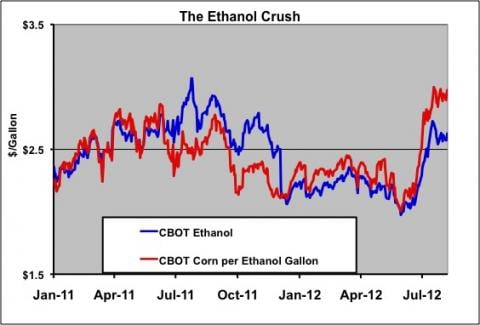

To get a rough idea about the economics of making ethanol from corn, analysts look at something called the ethanol crush. The ethanol crush is another one of those futures market terms like crack spread (we covered crack spreads in Part IV of The Bakken Buck Starts Here) designed to make things simple for those of us who never have to get our hands dirty in a corn field or a refinery.

The ethanol crush is the cost of the corn required to make a gallon of ethanol. You will doubtless recall from our prior treatise on the topic, (A Market of Contradictions etc…) that ethanol is pure alcohol. There will be those among you that inherited the family moonshine recipe and don’t need telling how much grain goes into a good grog. Nevertheless, according to analysts, a bushel of corn makes 2.75 gallons of ethanol. The ethanol crush therefore works out as: price for a bushel of corn / 2.75. Yesterday the CBOT price for corn was $8.18/bushel meaning the ethanol crush was $8.18/ 2.75 or $2.98/gal. The CBOT ethanol price yesterday was $2.63/gal. That means ethanol producers are losing 35 cnts/gallon (on paper at least – they make back a few cents on the byproducts left after the hooch is made). The chart below shows the ethanol crush (red line) against the ethanol price (blue line). You can see that corn costs have exceeded the ethanol price since the start of the year. These people apparently can’t make money making booze.

Source: CBOT Data from Morningstar

As a result, according to weekly Energy Information Administration (EIA) data, ethanol production has fallen by 17 percent since the start of 2012 and ethanol inventory levels have been falling since March (see chart below). During June of this year, Valero Energy, Abengoa Bioenergy US Holding Inc., and Nedak Ethanol LLC have idled production plants and others have cut capacity. The largest US ethanol producer, Archers Daniels Midland says its margins are -20 cnts/gal.

Join Backstage Pass to Read Full Article