The golden years of natural gas abundance are off and running, with export projects, new industrial proposals, new power generation use, and expanded transportation use - all building on a perception of long-term abundant supply at reasonable prices. Does it all work out in the end? Do supply and demand balance at stable, affordable prices, even with a lot more demand? Today we examine the likelihood that gas producers can provide adequate supplies without causing significant upward pressure on prices.

This is Part III in our series analyzing the concerns voiced by some as to whether the natural gas renaissance is real and sustainable, with plenty of natural gas at reasonable prices. In Part I “Golden Years: The Golden Age of U.S. Natural Gas,” we tackled the history of industry regulation before the shale era. In Golden Years: The Golden Age of U.S. Natural Gas Part II—How Much Gas Do We Need?, we developed a reasonable demand scenario out to 2025. [Why does our scenario go out to 2025? See the box insert for an explanation.] Our total U.S. demand estimate of 92.5 Bcf/d represented an upward adjustment of 15.5 Bcf/d over EIA’s 2013 estimate (77 Bcf/d) . We knew EIA’s demand estimate was balanced with supply at reasonable, stable prices (real, constant-dollar prices staying below $6.00 until the mid-2030s, and even nominal prices staying below $6.00 into the mid-2020s). Our initial goal in this episode was to determine whether our higher total demand estimate could be met without gas prices jumping higher.

|

Why Forecast Out to 2025? The middle of the 2020s coincides with a couple of key factors: It is when most of the LNG export projects and big petro-chemical projects are supposed to be fully up to speed and that timeframe is also beyond the tail end of the wave of coal power generation retirements that may be replaced with gas-fired generation. In addition, for an investment in pipe, processing, power generation, etc., going into service about the middle of the teens, the middle of a 20-year service life. So conditions in 2025 should be representative of what investors will be experiencing on average in their next round of infrastructure investments. Why not go all the way out to 2040, the way EIA does? The answer is pretty simple—too much can change, to rely in any way on the EIA forecasts. To get an idea of how far out 2040 is, let’s look back an equivalent period, 26 years to 1988. That was the year George H.W. Bush was elected president as Ronald Reagan was about to leave office. Few had heard of Bill Clinton, George W. Bush, or Barack Obama. The natural gas industry had not yet been restructured, wellhead prices had not yet been deregulated, and certainly no one had figured out how to crack the code to produce shale gas economically. We had two Iraq and one Afghanistan war ahead of us. And a typical private vehicle got about 15 to 19 miles to the gallon (vs. the 35 MPG you can buy now on average). So, bottom line—let’s not worry too much about 2040, by which time the ongoing rapid advances of gas production technology, alternative energy, efficiency technologies and who knows what else can be expected to give a completely different answer than any static forecast EIA, RBN or anybody else might develop. |

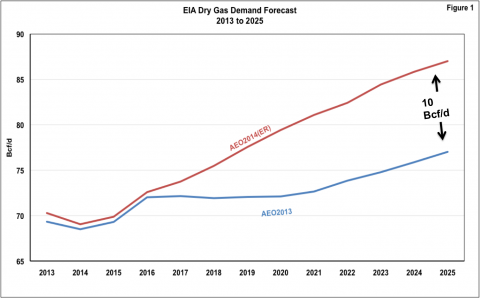

Well, what a difference a couple of weeks can make. Subsequent to that last blog installment, EIA issued the “early release” version of its next Annual Energy Outlook, AEO2014(ER). This new forecast starts to recognize much more demand than earlier versions, getting closer to a reasonable supply-demand target than we have seen EIA do in the past. Basically, by 2025 EIA has added about 10 Bcf per day of demand, reflecting big increases in industrial use, power generation and LNG exports over last year’s forecast. Figure 1 compares the forecast total demand from 2013 to 2025.

Source: EIA and RBN Energy (Click to Enlarge)

As of 2025, EIA’s outlook last year, AEO2013 - blue line on the chart - had demand at 77.0 Bcf per day. The new release, AEO2014(ER) – red line on the chart - shows total demand of 87.0 Bcf per day – a lot closer to the estimate from our previous blog of 92.5 Bcf/d.

In the new EIA outlook, industrial load by 2025 goes from 21.4 to 23.0 Bcf per day. Power generation goes from 23.2 to 26.0 Bcf per day. Pipeline exports go from 1.4 to 2.3 Bcf per day, and LNG exports go from 2.9 to 7.0 Bcf per day. The residual demand for all other sources is pretty flat at 28.7 Bcf per day.

EIA shows its supply forecast meeting the total load just fine with domestic production. And, even in the way-out years beyond the 2025 reference, EIA shows supply meeting greatly expanded demand with nominal prices not reaching double-digits until the mid-2030s.

However, there are two wrinkles in that supply-demand balance: First, as we indicated, a reasonable 2025 demand scenario is still somewhat higher than EIA’s new forecast, by about 5.5 Bcf per day. Second, in moving from its AEO2013 supply-demand forecast to this more robust AEO2014(ER) forecast, EIA shows some upward pressure on prices, about 30 cents or 5 percent in 2025.

This brings us to supply. Is EIA fully recognizing what the industry can do without a lot of upward price pressure? Can the industry meet an additional 5.5 Bcf per day in 2025 without adding to EIA’s upward pressure? No, EIA is not fully recognizing industry performance, and yes, the industry can do a lot more. EIA has always been, and continues to be, conservative in catching up with what the industry can actually do. This is not necessarily a criticism, given EIA’s mandated mission, but it does say that we should look very carefully at EIA forecasts before relying upon them in making decisions.

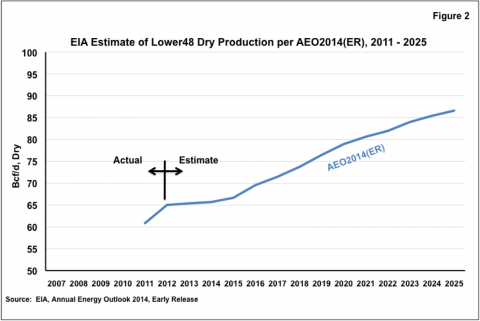

Source: EIA and RBN Energy (Click to Enlarge)

Let’s start with the production forecast used to balance with demand in AEO2014(ER). Figure 2 sets this out, starting at about 60 Bcf per day in 2011 and reaching 87 Bcf per day in 2025. That looks reasonable enough, right? The two years of actual history at the beginning of the study are succeeded by slight flattening of growth, but then by steady growth to meet demand.

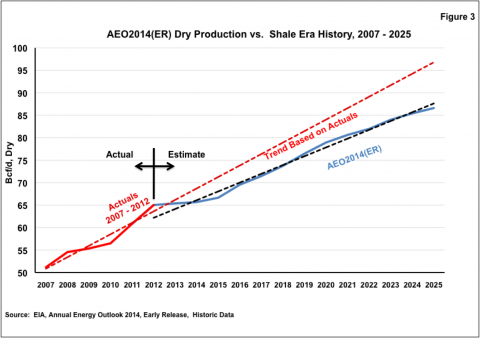

Well, that “slight flattening” and the subsequent rate of projected growth really make a big difference by 2025. By examining a little more history and a couple of trend lines, Figure 3 shows us how big a difference. Beginning in 2007, the year that shale development really gained traction (although it wasn’t “officially” recognized until 2008), and continuing through 2012, we see steep growth in U.S. production, from 52 Bcf per day to 65 Bcf per day (solid red line in Figure 3). If production were to stay on the trend line based on that six-year period, (shown as the dotted red line), the 2025 level would be 97 Bcf per day, rather than the 87 forecast by EIA (blue line in Figure 3) - an extra 10 Bcf per day to meet the additional 5.5 Bcf per day of demand discussed earlier. As we can see in comparing the actuals-based trend with the black dotted line describing the trend in the EIA forecast, it is clear that EIA is predicting a substantial slow-down in the pace of development.

Source: EIA and RBN Energy (Click to Enlarge)

The only problem with EIA’s premise is that it doesn’t seem to be happening. In fact, the actual production in 2013 through the first nine months, according to EIA, has averaged 66.1 Bcf per day, which is the exact value of the red trend line in Figure 3, as of 2013. And this is happening with a gas-directed rig count that has dropped by more than half. We will discuss some of the reasons for that continued success later in this series.

First, we need to look inside the EIA forecast at the primary component of rapid production growth - shale gas. Figure 4 shows the history of actual shale dry gas production from 2007 forward, in red, followed by EIA’s new shale production forecast in blue. The “flattening out” here is much more pronounced than it was in the total-supply estimate. Shale production that has been growing at nearly 5 Bcf per day on average every year is suddenly going to drop in 2013 and then be flat? Hmm.

Join Backstage Pass to Read Full Article