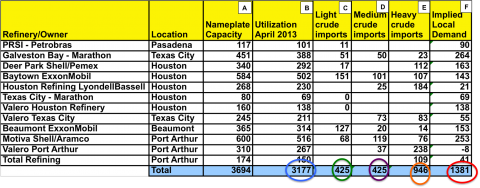

The latest available Energy Information Administration (EIA) data for April 2013 indicates that imports into Houston and Port Arthur region refineries on the Texas Gulf Coast included 425 Mb/d of light and 425 Mb/d of medium quality crudes. Seventy three percent of the imports that month were heavy crude. Domestic and/or Canadian supplies fed only 43 percent of the region’s 3.18 MMb/d crude demand. That balance of refinery crude supplies will change significantly by 2014 as increased domestic production finds a path to the Houston and Port Arthur regions via new and expanded pipeline capacity. Today we extend our Permian series by digging into the import data and building a Houston/Port Arthur refinery supply demand balance.

|

Check out Kyle Cooper’s weekly view of natural gas markets at |

Previously in this series on the Permian Basin we looked at crude production, existing pipeline takeaway capacity and local refinery consumption (see Rock The Basin – A Tight Pipeline Balance For Permian Crude). In Part 2 we looked at new pipeline capacity coming online in the next two years out of the Permian and compared it to the production forecast (see Opening the Permian Crude Floodgate). Although production and takeaway capacity are currently tightly balanced at 1.4 MMb/d, the congestion should ease by the end of 2013. In Part 3 we looked at refinery capacity in Houston and Port Arthur/Beaumont to understand whether there was enough light crude capacity available to process increasing Permian production (see Can Houston Refineries Absorb New Permian Crude Supplies). This time we dive a little deeper to look at crude import data in detail for Houston/Port Arthur area refineries during April of this year – the latest available data and try to create a refinery balance for the region to better understand how domestic crude supplies are replacing imported barrels.

In the previous episode we established that there is 3.7 MMb/d of refining capacity in the Houston and Port Arthur/Beaumont refining centers and that – according to their published capabilities – those refineries have 1.7 MMb/d of light and medium crude processing capacity. We estimated that, in April 2013, 640 Mb/d of light crude was reaching Houston by pipeline and by barge from the Permian Basin and the Eagle Ford. That data allowed us to reach a broad conclusion that there was more than enough refining capacity available to process new light crude volumes at the moment – assuming that refiners were replacing imports with these supplies. But that conclusion remains tentative until we look at the reported EIA company level import data to see how refiners are actually behaving.

The latest EIA import data available is for April 2013, so we went through the data refinery by refinery to figure out what quality of crude refiners were importing. Table # 1 below lists the refineries in the Houston and Port Arthur regions that we identified last time. Column “A” shows the nameplate crude capacity of the refinery and column “B” is the nameplate capacity multiplied by the EIA reported “Percentage Refinery Utilization” for April 2013 in the Texas Gulf Coast Region – 86 percent. Obviously that value is a generalization but it is the best information that we have.

Table # 1 - Source: EIA and RBN Energy (Click to Enlarge)

Columns “C’, “D” and “E” in the table are the EIA reported import volumes (Mb/d) for each refinery during April 2013. The EIA data includes the API gravity and the sulfur content for each reported crude import. We classified all crudes with an API of less than 24 as “Heavy”, crude with API gravity between 24 and 31 as “Medium” and higher than 31 as “light” for this analysis. [Note that EIA provide information about the destination port and the importing company but that does not guarantee the crude was processed by a particular refinery – there is still a lot of guesswork in these numbers.]

(Click to Enlarge)

Looking at the breakdown of the import data, we can see that during April 2013, refiners imported 425 Mb/d of light crude (green circle). The largest light crude importer was ExxonMobil (278 Mb/d) who received most of their light crude from Middle East suppliers. Medium crude imports accounted for another 425 Mb/d (purple circle) and 52 percent of imports were heavy crude (946 Mb/d – orange circle). (Yes, it just happens to work out that light and medium are the same number.) Also of interest in this data is the extent to which refineries owned by overseas producers are importing their national crudes. It appears these refiners do run a lot of their national crude. The Deer Park refinery that is a 50 percent joint venture between Shell and the Mexican State PEMEX imported all its heavy crude from Mexico. The Pasadena PRSI refinery owned by Brazilian national oil company Petrobras imported its only cargo in April – of light crude - from Trinidad and Tobago, which was likely a staging point from the true port of origin. The Motiva refinery that is joint owned by Shell and Saudi national oil company Aramco imported 60 percent of its crude from Saudi Arabia – including 68 Mb/d of light crude.

Join Backstage Pass to Read Full Article