As this brutally hot summer meanders towards Labor Day, we’re all facing rising gasoline prices as we head to the beach, to barbecues, or to the mall for back-to-school shopping. The main culprit is crude oil production cutbacks by the Russians and Saudis and the situation would likely be much more precarious were it not for strong U.S. shale output keeping gasoline prices from climbing to $5 a gallon or more — except in California, of course. Crucial to sustaining that production long-term is not just replenishing U.S. oil reserves but growing them. In today’s RBN blog, we continue our look at crude oil and natural gas reserves with an analysis of the critical issue of reserve replacement by major oil-focused U.S. producers.

In Say You’ll be There, we raised the question: “How much longer can the U.S.’s shale reserves support U.S. oil and gas production growth?” EIA estimates of “proved” reserves, which are assumed to have at least a 90% chance of eventual recovery under existing economic and operating conditions, imply about 10 years of remaining volumes of crude oil and condensate and 10-17 years of natural gas in the major producing basins. Critical to maintaining or improving these inventories are the rate at which U.S. producers are replacing the reserves they use up via production. Equally critical (especially in an era of heightened scrutiny over capital efficiency) is the price paid to achieve that rate.

In the previous installment of the reserves-replacement series we continue today, we examined the overall reserve replacement metrics of the 41 top U.S. E&Ps we monitor. Using three-year-average data, the most reliable method of analyzing long-term trends, we found that the reserve replacement rate bounced back from a major dip in 2020, when plunging prices resulted in massive negative reserve revisions, to a much healthier 200% in 2022. This doubling of the reserves added was accomplished at an average reserve replacement cost of just under $10 per barrel of oil equivalent (boe), compared with nearly $25/boe in 2016 and $15/boe in 2020. These results were achieved with a reinvestment rate (total cash flow divided by capital expenditures) of 39%, a 10-year low. That drove the average recycle ratio, a measure of profitability calculated by dividing the net profit per boe by the cost of finding and developing a barrel, to the 500% range in 2021 and 2022 — again, record performance. While these metrics suggest a healthy industry, we did find some causes of concern. For one, we found that the percentage of reserves replaced through finding and development activities has been declining while the cost of exploiting existing fields and development of new fields has been rising. Factors include the low reinvestment rate and inflation in oilfield service costs. Producers have been turning to acquisitions to bolster reserves, but this tactic doesn’t add to total U.S. reserves and potential targets are limited.

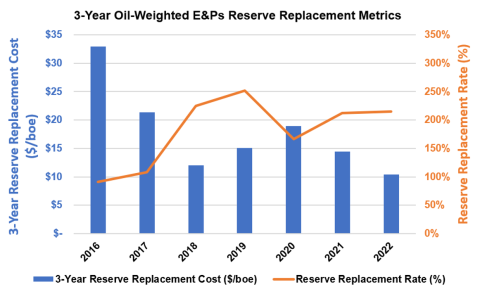

Today, in Part 2, we turn our focus to the largest oil-weighted producers, the performance of which is most crucial to addressing the important issue of the longevity of U.S. shale output. As shown in Figure 1 below, the onset of the pandemic in early 2020 had a less dramatic impact on the reserve replacement metrics of the oil-weighted E&Ps than the severe oil price plunge in 2014-15 (for this graphic, the three-year period in question culminated in 2016 – the blue bar to the far left and the left end of the orange line). The impact of the industry shift to the much more productive unconventional shale resources resulted in reserve replacement costs (blue bars, left axis) plunging from over $30/boe in 2016 to about a third of that cost in 2018. Replacement costs spiked in 2020 as negative reserve revisions (tied to the sharp decline in crude oil prices) offset reserve additions. Producers slashed capital expenditures but maintained reserve additions, leading to a decade-low three-year reserve replacement cost of $10.29/boe (blue bar to far right).

Figure 1. Oil-Weighted E&Ps’ 3-Year Reserve Replacement Metrics. Source: Oil & Gas Financial Analytics, LLC

Join Backstage Pass to Read Full Article