U.S. natural gas producers had a rough start to 2023, with spot prices dipping to just above $2.15/MMBtu this past spring. But optimism was abundant in midyear earnings calls on expectations that demand will eventually soar, driven largely by a near-doubling of U.S. LNG export capacity by the end of the decade. A key question, however, is whether E&Ps have built the inventories of proved reserves to support future production increases to meet that demand. In today’s RBN blog, we analyze the crucial issue of reserve replacement by the major U.S. Gas-Weighted E&Ps.

Before we began this four-part series, we asked, “How much longer can shale support U.S. oil and gas production?” In Say You’ll be There, we said that Energy Information Administration (EIA) estimates of proved reserves, which are assumed to have at least a 90% chance of eventual recovery under existing economic and operating conditions, imply about 10 years of remaining volumes of crude oil and condensate and 10-17 years of natural gas in the major producing basins. Critical to maintaining or expanding these inventories is the rate at which U.S. producers are replacing the reserves they produce. Equally important — especially in an era of heightened scrutiny over capital efficiency — is the price paid to achieve that replacement rate.

In the first episode of our series, we examined the overall reserve replacement metrics of the 41 top U.S. E&Ps we monitor. Using three-year average data, the most reliable method of analyzing long-term trends, we found that the reserve replacement rate bounced back from a major dip in 2020, when plunging prices resulted in major negative reserve revisions, to 200% in 2022. This doubling of the reserves added was accomplished at an average reserve replacement cost of just under $10/boe, compared with nearly $25/boe in 2016 and $15/boe in 2020. These results were achieved with a reinvestment rate (total cash flow divided by capital expenditures) of only 39%, a 10-year low. In Replace Me, Part 2, we revealed that the major U.S. Oil-Weighted producers were instrumental in driving that reserve replacement performance. The reserve replacement rate for the oil-focused group soared from 24% in 2020 to 357% in 2021 and 244% in 2022.

In Replace Me, Part 3, we turned our focus to the largest Diversified producers, which have more balanced portfolios weighted between 40%-70% for both oil and natural gas. The three-year reserve replacement rate for the group recovered from 133% in 2020 to 179% in 2021 and 177% in 2022 — rates well below the replacement rates generated by the Oil-Weighted producers. Dragging down the overall results were tepid replacement rates from finding and developing (F&D) activities. The Diversified peer group’s three-year replacement rate from organic activities plunged to 77% in 2020 and only slowly recovered to 91% in 2021 and 100% in 2022 — in other words, barely replacing output. Replacement costs did jump from $9.03/boe in 2019 to $13.76/boe in 2020 and over the next two years have settled at just below that level, the highest among the three groups of producers. Among the questions raised by this performance was whether the higher gas-weighting of their portfolios contributed to this underperformance, an issue we could address by examining the reserve replacement results of the Gas-Weighted producers.

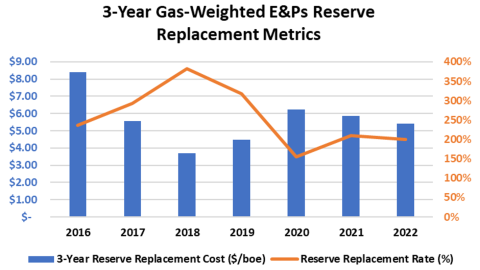

Figure 1. Gas-Weighted E&Ps’ 3-Year Reserve Replacement Metrics.

Source: Oil & Gas Financial Analytics, LLC

Join Backstage Pass to Read Full Article