The U.S. is still years away from establishing a national carbon tax or cap-and-trade system — and it’s certainly possible it will never take either step. But there are state and regional cap-and-trade programs in place to incentivize refiners and others to reduce their greenhouse gas (GHG) emissions. In today’s RBN blog, our fourth and final on carbon emissions and the refining sector, we look at state and international efforts to reduce GHG emissions and their prospective impact on the U.S. refining industry.

In Part 1 of this series, we gave an overview of emissions from refineries, technical ways to mitigate them, and how those policies might ultimately influence refining competitiveness. In Part 2, we investigated the policy options deployed in Europe and how its Emissions Trading System (ETS) is affecting the European Union’s (EU) refining industry as a whole, then looked at Canada’s carbon tax in Part 3, including how it works and the future impacts on oil sands producers, bitumen upgraders and refiners.

First, a reminder: A carbon tax and a cap-and-trade system are two distinct approaches to reducing GHG emissions. A carbon tax sets a fixed price on GHG emissions that is paid by all identified participants — typically fossil-fuel suppliers, power plant operators and other emission-intensive industries. Under a cap-and-trade system, in turn, the government sets a GHG emissions cap and then issues allowances, which permit a certain amount of emissions over a specific period. Covered entities can buy, sell, or trade those allowances to meet their emissions targets. This approach is designed to help ensure that the combined efforts of all participants are as cost-effective as possible.

To date, no state has implemented a carbon tax and neither has the federal government. There are two cap-and-trade programs currently employed in the U.S. — one regional and the other a single-state effort. The first to be developed was the Regional Greenhouse Gas Initiative (RGGI), which covers the Mid-Atlantic and Northeastern states but only applies to the emissions from fossil fuel power generators. The second system is the California Air Resources Board’s (CARB) cap-and-trade program, which covers about 80% of California’s emissions, especially large power and industrial emitters, including refineries.

Since the RGGI doesn’t impact refineries, we will focus on the CARB program, which as you would expect affects only refineries in that state. After that, we’ll look at a second way that a larger share of U.S. refineries and other industrial emitters may be impacted by carbon pricing, namely carbon border adjustment mechanisms (CBAM) in other countries.

California’s Cap-and-Trade Program

California’s Assembly Bill 32 (AB 32), enacted in 2006, directed CARB to establish a plan for the state to reduce its GHG emissions to 1990 levels by 2020, beginning in 2012. The cap-and-trade program established by the law is similar to the overall structure of the EU’s ETS, although there are some differences when you dig into the details. (We should also note that the CARB program is similar to the cap-and-trade system of Quebec, which we mentioned in Part 3.) AB 32 was also responsible for creating the state’s Low Carbon Fuel Standard (LCFS) program, which we’ve discussed in numerous blogs over the years.

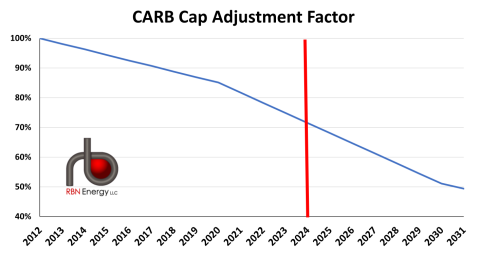

Figure 1. CARB Cap Adjustment Factor, 2012-31. Source: CARB

Join Backstage Pass to Read Full Article