Many governments around the world are looking for ways to incentivize reductions in greenhouse gas (GHG) emissions and two approaches have received the most attention: cap-and-trade and a carbon tax. The European Union (EU) has chosen the former, Canada has opted for the latter, and the U.S. — well, that’s still to be determined. It’s logical for oil and gas producers, refiners and others in carbon-intensive industries to wonder, what does it all mean for us? In today’s RBN blog, we look at Canada’s carbon tax (which it refers to as a “carbon price”), explain how it works, and examine its current and future impacts on oil sands producers, bitumen upgraders and refiners.

This is the third blog in our series on carbon dioxide (CO2) emissions, which dives into the complex arenas of oil refining and carbon regulations, and how they may increasingly impact the competitive playing field for refiners. In Part 1, we started off with a big-picture view of refineries and the CO2 they generate and emit, and provided a brief overview of the policy options governments have to “nudge” refineries to reduce their emissions. In Part 2, we took a deep dive into one of the policy options, cap-and-trade, by examining the EU’s Emissions Trading System (ETS). We also noted some of the shortcomings of that scheme and said its effectiveness in curbing emissions remains to be proven. Today, we will look at another policy tool governments can use: a carbon tax.

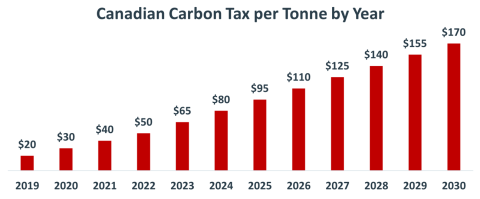

Figure 1. Canadian Carbon Price per Tonne by Year in Canadian Dollars. Source: Government of Canada

Join Backstage Pass to Read Full Article