Rising global interest in clean ammonia — plus the potential for earning generous federal tax credits — spurred a host of project announcements over the past couple of years, with the first new production capacity slated to start up as soon as 2025. But reality is setting in regarding the pace of clean-ammonia demand growth and the financial, regulatory and other challenges of developing complicated, big-dollar projects, particularly those involving carbon capture and sequestration (CCS). In today’s RBN blog, we provide an update on the major clean ammonia proposals we’ve been tracking.

As we discussed in our three-part blog series on clean ammonia last spring (see It’s Time), the chatter around the potential for clean ammonia to become a significant energy source was finally beginning to morph into the reality of clean ammonia project announcements, engineering-procurement-construction (EPC) contracts and final investment decisions (FIDs). We noted that there are two primary drivers behind the shift from talk to action: (1) the supercharged tax credits for CCS in the Inflation Reduction Act (IRA) and (2) the expanding efforts by power generators in Japan and South Korea in particular to make clean ammonia an important part of their fuel mix going forward. There are other drivers too, including overseas interest (especially in Europe) in de-carbonizing the power-generation and industrial sectors through the increased use of clean hydrogen — hydrogen-packed ammonia is an efficient carrier (or “suitcase molecule”) for transporting hydrogen by ship — as well as interest among global shippers in using ammonia as a low-carbon bunker fuel.

Before we delve into our project updates, a reminder that clean ammonia is produced by reacting either blue or green hydrogen with nitrogen (supplied from an air separation unit) using the Haber-Bosch process (a catalyst, high temperature and high pressure). Blue hydrogen is produced by running natural gas through either a steam methane reformer (SMR) or through an auto thermal reformer (ATR) and capturing and sequestering most of the carbon dioxide (CO2) generated by the process — typically about half of the CO2 when an SMR is used and 90%-plus with an ATR. Green hydrogen, in turn, is produced by running water through a renewables-powered electrolyzer to produce hydrogen and oxygen — no CO2 is produced, so there’s no need for CCS. (For more on the blue and green hydrogen projects under development, see our weekly Hydrogen Billboard.)

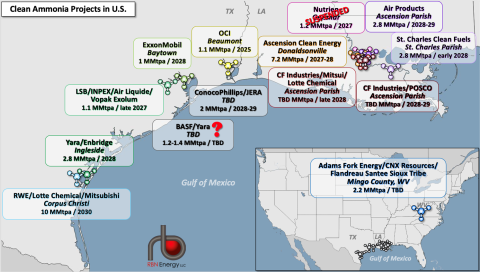

We've been tracking 14 U.S. clean ammonia projects, all but one of which would be sited along the Gulf Coast, which has ready access not only to natural gas but also to a number of planned CCS facilities and export terminals that either can handle ammonia or could be fitted to do so. As you’ll see — and as you might expect — the proposals that remain on track are generally those planned or backed by deep-pocketed, larger companies with extensive experience in developing complex projects and lining up the large, reliable buyers that make such projects possible.

Figure 1. Clean Ammonia Projects in the U.S. Source: RBN

Join Backstage Pass to Read Full Article