Guyana’s crude oil production is surging, a trend that is expected to continue through the rest of the decade, and with no domestic refining industry its exports are booming. Shipments of Guyana’s medium-density, sweet-ish crude to the U.S. have ramped up and are increasingly making their way to the West Coast, which relies on imports given its lack of easy access to domestic shale crudes and limited regional output. In today's RBN blog, the second in a series, we‘ll examine where Guyana’s barrels are ending up and how they stack up against competing grades.

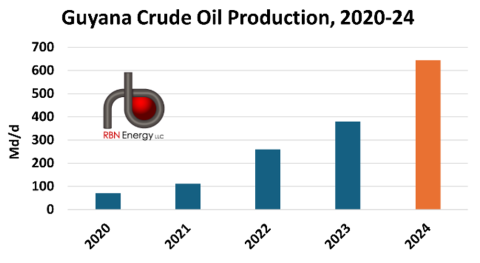

As we discussed in Break My Stride, Guyana’s crude oil production has accelerated from 70 Mb/d in 2020 to 380 Mb/d in 2023 (blue bars in Figure 1 below) and is expected to reach 645 Mb/d this year (orange bar). All of Guyana’s output comes from a single offshore block known as Stabroek, which spans 6.6 million acres and has reserves most recently estimated at 10 billion barrels of oil equivalent (boe). Stabroek (the old name for Georgetown, Guyana’s capital city) is being developed by partners ExxonMobil (45%), Hess (30%) and China’s CNOOC (25%). ExxonMobil, which also serves as the operator, began oil and gas activities there in 2008, collecting and evaluating 3D seismic data. It drilled its first well in 2015, leading to the group’s first significant oil find, which is known as the Liza project. Phase 1 of Liza began production in late 2019; then came Liza Phase 2, which began service in 2022; and then Payara in 2023. The consortium has since identified over 30 oil and gas discoveries in Stabroek. (All of this is happening as the three partners are embroiled in a legal fight and the government deals with a years-long territorial dispute with Venezuela.)

Figure 1. Guyana Crude Oil Production, 2020-24. Source: EIA

Three floating production, storage and offloading vessels (FPSOs) named Liza Destiny, Liza Unity and Prosperity have been extracting oil and gas from the Liza 1, Liza 2 and Payara projects, respectively. The extracted oil is temporarily stored in the FPSOs, then transferred to export tankers using hoses. The production facilities can receive a wide variety of ship classes, including Very Large Crude Carriers (VLCCs; capacity about 2 MMbbl), Suezmaxes (800 Mbbl-1 MMbbl) and Aframaxes (500-750 Mbbl).

Join Backstage Pass to Read Full Article