The Light Louisiana Sweet (LLS) crude market has evolved in recent years, due largely to the reversal of the Capline pipeline as well as limited production growth from the offshore fields that contribute to the LLS market. Yet the LLS premium against other U.S. grades remains strong, a sign that refiners aren’t ready to give up on it just yet, given its attractive yields of high-value transportation fuels like gasoline, jet fuel and diesel. In today’s RBN blog, we will revisit LLS and examine its production and demand outlook.

Long before the Magellan East Houston (MEH) assessment was established in 2016, LLS — a light, low-sulfur regional benchmark that is often the priciest in the U.S. physical crude complex — was the preeminent marker that determined the balancing point between imports and exports. U.S. refiners would track the grade’s differential to global benchmark Brent crude to weigh the merits of taking barrels from the North Sea or the Middle East instead. LLS has an API gravity of 34-41 and 0.4% (maximum) sulfur. (As we noted in The Weight, crude’s gravity or density is usually measured in terms of its API number; the higher the API, the lighter, or less dense, the crude). Even though LLS is considered a superior grade to most other U.S. crudes because of its lucrative fuel yields, its profile diminished after the Shale Revolution unleashed much higher volumes of similar, light, low-sulfur (sweet) crudes that compete with it. While some of this bountiful shale production is blended into LLS, keeping it amply available may not be as easy, as there are headwinds coming up for the grade over the next few years, which we will address in today’s blog.

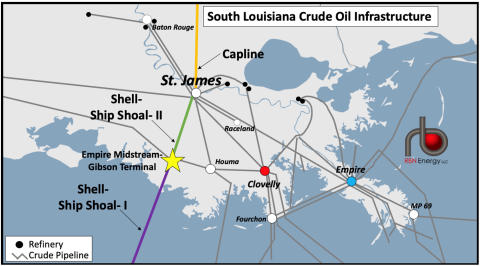

Figure 1. South Louisiana Crude Oil Infrastructure. Source: RBN

Let’s start with the crudes that make up LLS. Its sources have broadened significantly beyond field production in the Gulf of Mexico (GOM) in recent years. In fact, blended volumes have long dominated the LLS pool, with the grade’s output from offshore fields (known as pure LLS) accounting for only a small fraction of total supply. LLS availability is estimated at 300-350 Mb/d, of which roughly 10% (~30 Mb/d) comes from offshore fields. A decade ago, pure LLS contributed up to 30% of the blend. There may have been quality issues in blended LLS, but not severe enough to keep buyers away, with the market largely accepting the two versions — pure and blended — as intrinsically part of the overall grade. LLS usually trades for delivery at St. James, LA, (see Figure 1 above) a major U.S. oil hub that offers access to rail and water (it lies just 60 miles up the Mississippi River from the Gulf) and, most importantly, connectivity with multiple onshore and offshore pipes, a big bonus for LLS buyers and producers.

Join Backstage Pass to Read Full Article