Mexico’s efforts to start up the newest addition to its refining system — the Olmeca refinery — are causing headaches for global buyers of its crudes. Few are convinced that the plant near the country’s key Dos Bocas oil port is ready for service. Yet its operator, Petróleos Mexicanos (Pemex), surprised many with cuts to its crude exports in April, which were reportedly made to ensure the complex will have enough feedstock and could continue through 2024. In today’s RBN blog, we will discuss what led to the export cuts, the implications for importers, and potential replacement options.

Before we delve into the Olmeca refinery — commonly referred to as Dos Bocas given its location — and Mexico’s oil refining industry, lets revisit the existing crude fundamentals. As we noted in When Worlds Collide, global crude oil supply is tight in large part due to the OPEC alliance’s production curtailment initiatives, with the latest being 2.2 MMb/d in voluntary output cuts that are expected to extend beyond Q2. These are aimed at balancing the market while bolstering prices. U.S. refiners also may find it tougher to access the Western Canadian oil they’ve been accustomed to now that the long-awaited Trans Mountain Expansion Project (TMX) is online, making Alberta oil more available to buyers along the U.S. West Coast and the Pacific Rim. (TMX began commercial operations May 1.)

Balances could get strained even further if more oil is taken off the market — for instance, via Mexico. A few weeks ago, Pemex notified its crude buyers that its export volumes in April would be reduced. Reuters reported that the reductions totaled 436 Mb/d — 247 Mb/d of Isthmus-grade crude, 122 Mb/d of Maya crude and 67 Mb/d of Olmeca. Our understanding is that one U.S. Gulf Coast (USGC) customer was expecting the cuts to be repeated several times this year. Reductions to May shipments were expected to be at least 330 Mb/d but following its initial communication Pemex started to reoffer some supply for May to a few customers, in a sign that it may be temporarily reversing some of the export cuts. (According to news reports, more domestic crude had become available because of incidents at Pemex’s Salina Cruz and Lazaro Cardenas refineries in March, planned maintenance at a few other plants, and the slow startup at the Olmeca refinery.)

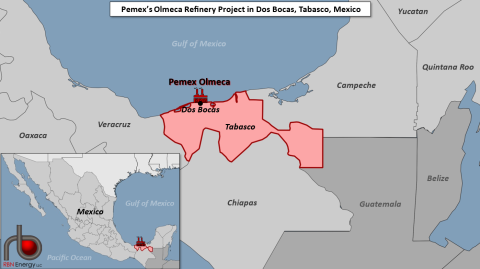

The new 340-Mb/d Olmeca refinery (see Figure 1 below), along with upgrades planned at Mexico’s six other refineries (see Maya Mia!), are part of a broader goal of President Andrés Manuel López Obrador (aka AMLO) to boost refining performance and make the country self-sufficient in fuels like gasoline and diesel. In 2021, state-owned Pemex said it would slash and eventually end its crude exports by 2023 because its refineries, including Olmeca, would need all the domestic oil it produces.

Figure. 1. The Olmeca/Dos Bocas Refinery in Mexico. Source: RBN

Join Backstage Pass to Read Full Article