Through a pair of newly announced, multibillion-dollar acquisitions, ONEOK is following up on its game-changing purchase of Magellan Midstream Partners by gaining additional scale, significantly increasing its role in NGLs and adding a huge crude oil gathering system in the Permian. The new deals are designed in large part to help ONEOK “feed and fill” its gas processing plants, takeaway pipelines and fractionators. In today’s RBN blog, we’ll discuss the details and implications of ONEOK’s newly announced plan to acquire EnLink Midstream and Medallion Midstream.

If you wondered whether consolidation within the midstream sector had run its course, the answer is a hard and emphatic “No!” No sooner had we posted a blog about Enterprise acquiring Piñon Midstream and its Dark Horse sour-gas gathering and treatment system in the Permian’s Delaware Basin [see A Horse With (New) Name] — the latest among several recent blogs about one midstreamer buying another — than ONEOK announced August 28 that it had reached definitive agreements with Global Infrastructure Partners to acquire two of its largest U.S. holdings. (GIP, a large international infrastructure fund with more than $100 billion in assets under management, is itself in the process of being acquired by BlackRock.)

The slightly larger of ONEOK’s two deals call for the Tulsa, OK-based midstream company to acquire GIP’s entire interest in EnLink Midstream for a total cash consideration of about $3.3 billion, including $300 million for GIP’s 100% interest in EnLink’s managing member and $3 billion for 43% of EnLink’s outstanding common units at $14.90 per unit, a 12.8% premium to EnLink’s closing price on August 27. ONEOK said that following the close of the transaction in Q4 2024 it intends to pursue the acquisition of the other 57% of EnLink’s common units in a tax-free transaction through the exchange of EnLink units for ONEOK stock.

Under the second deal, also announced August 28 and expected to close in Q4 2024, ONEOK will pay GIP $2.6 billion to acquire Medallion Midstream, which owns and operates the largest privately held crude oil gathering and transportation systems in the Permian’s Midland Basin and owns other Permian assets as well.

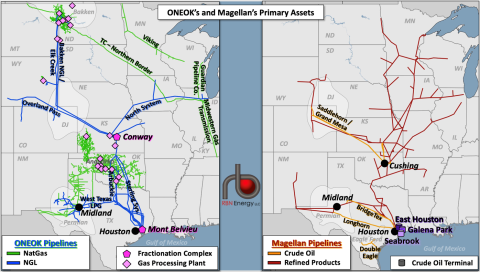

Before we discuss EnLink’s and Medallion’s assets and how they complement — and add value to — ONEOK’s, we should take a moment to recap ONEOK’s transformational September 2023 acquisition of Magellan Midstream. That $18.8 billion deal, which we examined in Tulsa Time, created the second-largest U.S. midstream company by market capitalization and the fifth-largest by enterprise value. It also gave ONEOK — which until then had been focused exclusively on gathering, processing and transporting natural gas and NGLs (see map to left in Figure 1 below) — Magellan’s extensive portfolio of crude oil and refined-products pipelines and crude oil terminals (see map to right).

Figure 1. Primary Assets of ONEOK and Magellan Before Their Combination. Source: ONEOK

Join Backstage Pass to Read Full Article