Enterprise Products Partners, already a leading provider of “well-to-water” or “well-to-market” midstream services out of the Permian, recently announced a deal to acquire private-equity-backed Piñon Midstream for $950 million in cash. But this isn’t just another bolt-on. Over the past few years, Piñon has been building out its one-of-a-kind Dark Horse system, which gathers and treats “sour” associated gas in a highly prolific, crude-oil-saturated part of the northern Delaware Basin and permanently sequesters the resulting hydrogen sulfide (H2S) and carbon dioxide (CO2) deep underground. In today’s RBN blog, we’ll discuss the impending Enterprise/Piñon acquisition, what Dark Horse does and how it gives Enterprise access to what may be the next hot production area in the Permian.

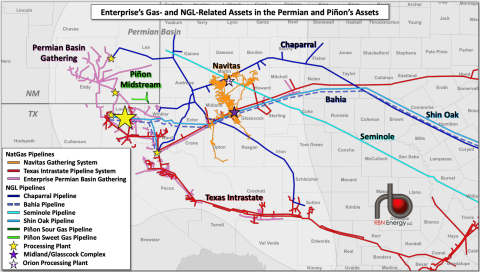

Before we get to the recently announced Piñon Midstream deal and the Dark Horse system, let’s look at the set of Permian-related natural gas and NGL assets Enterprise had already assembled. For starters, Enterprise owns and operates the 1,722-mile Permian Basin Gathering System (pink lines) in the Delaware Basin and nine gas processing plants (one yellow star per site) there — Chaparral, Mentone I, Mentone II, Mentone III, Orla I, Orla II, Orla III, South Eddy and Waha — with a combined capacity of 2.8 Bcf/d. The company also is building two 300-MMcf/d plants in the Delaware: Mentone West I (aka Mentone IV) and Mentone West II (aka Mentone V), which will come online in the second half of 2025 and the first half of 2026, respectively). (Mentone/Mentone West is the large yellow star.)

Figure 1. Enterprise’s Gas- and NGL-related Assets in the Permian and Piñon’s Assets. Source: RBN

Join Backstage Pass to Read Full Article