The Marcellus/Utica is a natural-gas-and-NGLs play, right? Almost entirely, yes. But a handful of dogged, innovative E&Ps have been producing fast-rising volumes of superlight crude — better described as condensate — in the Utica Shale’s “volatile oil window” in eastern Ohio. In today’s RBN blog, we discuss recently ramped-up drilling-and-completion activity in that swath of the Buckeye State, the potential for more growth through the second half of the 2020s, and the impact of increasing output on Midwest midstreamers and refiners.

Few would have guessed it a quarter-century ago, but the Marcellus/Utica region in Pennsylvania, Ohio and West Virginia is now one of the world’s most prolific and vital natural gas production areas, with output currently topping 32 Bcf/d and decades of reserves yet to be tapped. The overlapping shale plays generate hundreds of thousands of barrels of NGLs per day that are consumed in the Northeast and Midwest, piped or railed away to other U.S. and Canadian markets — or piped to the Marcus Hook export terminal near Philadelphia and shipped overseas.

What’s less well-known is that parts of the Utica play — mostly in a few counties in eastern Ohio — also produce relatively modest amounts of crude oil, almost all of it condensate with an API value (or viscosity) of 55 to 59 degrees. More recently, at least a couple of E&Ps in the Utica have been producing small volumes of “heavy condensate” with an API value of 49 to 52-degrees — still far lighter than West Texas Intermediate (WTI), which has an API of about 40 degrees. (Despite the wide variation in the viscosity of condensate being produced in the Utica today, all condensate barrels in the play are currently fungible — though that may change, as we’ll discuss later.)

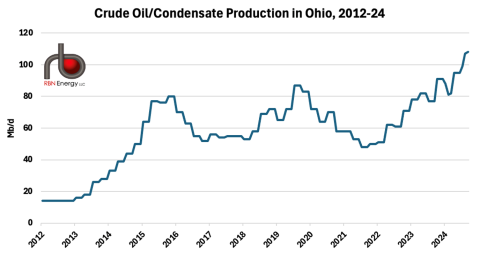

In the Pre-Shale 2000s, crude oil/condensate production in the three Marcellus/Utica states — the last gasp of output from conventional oil and gas wells drilled years earlier — was flat-lining at de minimis levels. But a sharp rise in drilling-and-completion activity pushed Ohio production alone to a peak of 80 Mb/d in the fall of 2015 and a pre-COVID peak of 87 Mb/d in the summer of 2019 (from only 14 Mb/d in 2012; see Figure 1 below). And, as we’ll get to later, production has been on a tear since the winter of 2021-22, more than doubling from a post-pandemic low of 48 Mb/d to 108 Mb/d in September, the latest EIA data available.

Figure 1. Crude Oil/Condensate Production in Ohio, 2012-24. Source: EIA

Join Backstage Pass to Read Full Article