The budget reconciliation bill signed into law July 4 by President Trump — known as the One Big Beautiful Bill Act (OBBBA) — dramatically scales back a number of clean-energy tax credits and adds a new layer of complexity for some projects, leading to a lot of doom and gloom around clean-energy initiatives, but the new legislation is a big positive for the carbon-capture industry. In today’s RBN blog, we look at how changes to the 45Q tax credit could help advance carbon-capture efforts while also providing a boost to producers of crude oil and blue hydrogen.

Let’s start with a quick refresher on carbon capture. When carbon dioxide (CO2) is captured and stored, and that’s all, the process is called carbon capture and sequestration (CCS) and requires a Class VI injection well for long-term storage in deep geologic formations. If the CO2 is used for some other process before it’s stored, it is called carbon capture, use and sequestration (CCUS) and for certain applications requires a much-easier-to-permit Class II injection well — the most common example being the type used in enhanced oil recovery, or EOR. Permitting for Class VI wells is typically handled by the Environmental Protection Agency (EPA), although a few states have gained control over that process, something referred to as primacy, and a handful of others, including Texas, are attempting to do the same.

As we discussed in our blog series on CO2 EOR, the technology has been around for over 50 years. There are more than 5,000 miles of CO2 pipeline in the U.S. owned by 29 companies — the leaders being ExxonMobil/Denbury, Occidental Petroleum (Oxy) and Kinder Morgan. More than half of those pipeline miles transport CO2 to EOR production and sequestration facilities in the heart of the Permian Basin. EOR is a well understood, proven technology, and also produces the crude oil with the lowest CO2 footprint.

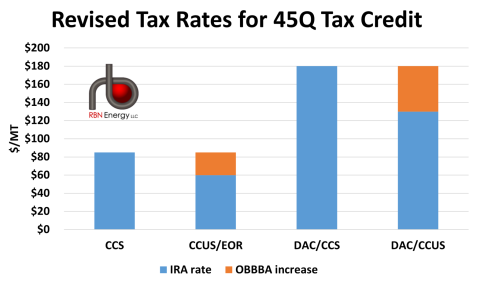

To drive development in the carbon-capture industry, Congress created the 45Q tax credit. It was added to the federal tax code in the Energy Improvement and Extension Act of 2008, then expanded and extended under the Bipartisan Budget Act of 2018. But the more generous tax credits didn’t spur a lot of activity, which is why improvements to the tax credit were included in 2022’s Inflation Reduction Act (IRA). Credits jumped to $85 per metric ton (MT) for CCS and $60/MT for CCUS, up from $50/MT and $35/MT, respectively. Direct air capture (DAC), a far more expensive process, had been eligible for credits at the CCS and CCUS rates before the IRA. Its credit rates rose to $180/MT for CCS and $130/MT for CCUS. (Also note that all those enhanced credits under the IRA came with prevailing-wage and apprenticeship requirements.)

The 45Q tax credit has generally enjoyed bipartisan support since its creation, although the different rates for CCS and CCUS/EOR have always been a bone of contention. Supporters of evening out the rates have long argued that it shouldn’t matter how the CO2 is sequestered as long as it’s done securely, while skeptics of that approach have maintained that using carbon-capture technology to boost crude oil production is counterproductive and conflicts with wider decarbonization goals. A bill introduced in the Senate by a trio of Republican lawmakers in 2024 would have raised the CCUS/EOR rates to $85/MT (and to $180/MT using DAC), but it failed to advance.

Efforts to establish parity between the CCUS/EOR and CCS rates gained new momentum this spring as Republicans in Congress began constructing the legislation that would become the OBBBA. As part of an effort to reduce spending, fund a package of tax cuts and refocus U.S. energy priorities, the Trump administration and Congress quickly zeroed in on the IRA’s tax credits, including the Clean Hydrogen Production Tax Credit (45V), the Clean Energy Production Tax Credit (45Y) and the Clean Energy Investment Tax Credit (48E). But while the final legislation dramatically scaled back many of these tax credits, it was mostly positive for 45Q and the carbon-capture industry.

Figure 1. Revised Rates for the 45Q Tax Credit. Source: RBN

Join Backstage Pass to Read Full Article