In the race to build the next deepwater crude oil export terminal in the Gulf of Mexico, Sentinel Midstream’s proposed Texas GulfLink (TGL) has become one of the frontrunners. TGL’s plan gained its crucial Record of Decision (ROD) Approval from the U.S. Department of Transportation’s Maritime Administration (MARAD) on February 14, but there is still some distance to go before a final investment decision (FID) is reached. In today’s RBN blog we’ll discuss Sentinel’s TGL plan, why it might be uniquely positioned to move forward, and the other contenders still in play.

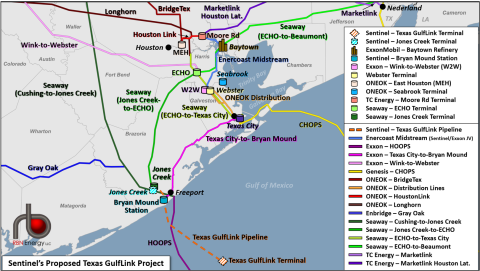

Let’s start with a refresher on the TGL project and efforts to build a deepwater export terminal in the Gulf of Mexico*. TGL, which at one point was considered a Dark Horse in the multi-year competition, would feature a deepwater platform (orange-and-white striped square in Figure 1 below) able to load a tanker at a rate of 85 Mb/hour, 2 MMb/d, which would allow it to fully load a Very Large Crude Carrier (VLCC) in one day. The platform, located nearly 30 miles offshore Freeport, TX, would be connected via the 42-inch-diameter Texas GulfLink Pipeline (dashed orange line) to an onshore storage terminal at Jones Creek (aqua-and-white-striped tank icon west of Freeport) in Brazoria County. At the onshore facility, about 9 MMbbl of above-ground tanks would be supplied from the Houston area, including the Webster Terminal (pastel-yellow tank icon), giving the project access to significant volumes of Permian originated crude oil, in addition to other grades feeding that market.

[*Yes, we know that Gulf of Mexico has been renamed Gulf of America by the Trump administration. For now, we are going to stick with Gulf of Mexico not out of protest or spite, but because that is what it is still called by the majority of the energy market.]

Figure 1. Sentinel’s Proposed Texas GulfLink Project and Other Nearby Infrastructure. Source: RBN

We’ve written a great deal in the RBN blogosphere about the fierce, multi-year competition to build a deepwater terminal (see Gulf Coast Time). U.S. crude export volumes took off in the 2010s and were expected to continue growing along with production throughout the 2020s, driving the market to seek the most efficient export options. Prior to 2018, numerous terminals were proposed along the Gulf Coast including a number of offshore single-point mooring (SPM) facilities that would be able to fully load a VLCC without reverse lightering. However, in the downturn of 2020, some of those projects were scrapped, leaving four developmental projects and the one in-service offshore facility in Louisiana.

Join Backstage Pass to Read Full Article