Crude-oil-focused production growth in the Permian is generating increasing volumes of associated gas that need to be processed and mixed NGLs that need to be piped to Mont Belvieu, fractionated and exported. All that suggests the need for still more infrastructure — processing plants, NGL pipelines, fractionators and export facilities — and Enterprise Products Partners, a top-tier NGL midstreamer, recently laid out a multibillion-dollar plan to help Permian producers keep pace. In today’s RBN blog, we discuss the new set of projects Enterprise has in the works.

We recently concluded a seven-part series on the handful of large U.S. midstream companies with the sequential assets — the NGL networks — capable of taking NGL molecules from wellheads in the Permian and other liquids-rich plays to the ultimate U.S. recipients of NGL purity products, be they petrochemical plants, refineries, propane distributors, or NGL export terminals. And wouldn’t you know it, Enterprise followed up our series with a blockbuster announcement of perhaps the most comprehensive set of new NGL-related infrastructure projects in years.

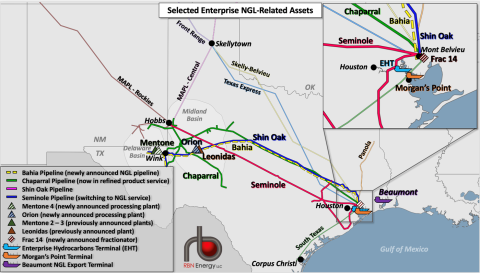

Before we begin our discussion of those projects and their significance, we should note it took two blogs in our recent NGL networks series to describe everything that Enterprise already had going on regarding NGLs. In the first of those two blogs, we discussed the company’s more than 10 Bcf/d of net gas-processing capacity, about three-quarters of which is located in the Permian, the Eagle Ford, the Piceance and the Green River production areas (the latter in Colorado and Wyoming, respectively). We also looked at the set of Enterprise pipelines that move mixed NGLs (aka Y-grade) from processing plants to Mont Belvieu, including the Shin Oak Pipeline (67% owned by Enterprise) and the Chaparral Pipeline system, both of which run from the Permian. (More on those in a moment.). And we cataloged the company’s massive NGL storage and fractionation complex in Mont Belvieu (130 MMbbl of space in underground salt caverns and 1.1 MMb/d of fractionation capacity).

In our second blog on Enterprise we examined the balance of the company’s NGL- and petchem-related network, which includes pipelines that distribute purity products to domestic customers and export terminals; isomerization units that make isobutane from normal butane and propane dehydrogenation (PDH) plants that convert propane to propylene; plants that produce octane-enhancing isobutylene from isobutane and methyl tertiary butyl ether (MTBE) from isobutylene; pipelines that move ethylene produced by area steam crackers and Enterprise’s Morgan’s Point export terminal; and finally, the company’s Enterprise Hydrocarbons Terminal (EHT) and Morgan’s Point itself. As we put it, “Enterprise’s NGL value chain extends beyond purity products to petrochemical and fuel commodities (isobutylene, MTBE, ethylene and propylene) derived from purity products.” In other words, to say it’s a soup-to-nuts operation would be an understatement.

One more thing: in last month’s OMG, we discussed the ongoing build-out of Permian gas processing capacity that is an essential precursor to production growth in West Texas and southeastern New Mexico. There, we noted that Enterprise alone was planning three 300-MMcf/d processing plants — the Leonidas plant in the Midland Basin (due in service in Q1 2024) and, in the Delaware Basin, Mentone 2 (now operational) and Mentone 3 (also due online in Q1 2024).

Figure 1. Selected Enterprise NGL-Related Assets. Sources: Enterprise, RBN

Join Backstage Pass to Read Full Article