It’s been a tough couple of months for developers of large-scale, multi-state carbon capture and sequestration (CCS) projects, which have been stung by widespread public opposition and often hamstrung by state and local regulations. But while those factors helped lead one developer to pull the plug on its project and another to push back its schedule by a couple of years, that’s not to say there isn’t a path forward for some projects. In today’s RBN blog, we examine why Wolf Carbon Solutions’ targeted approach and a pipeline conversion by Tallgrass Energy could be the most likely CCS projects to reach operational status.

Ethanol plants have long been an obvious choice for carbon capture, given that the carbon dioxide (CO2) resulting from ethanol fermentation is highly concentrated, which makes capturing it more efficient (and less expensive) compared to many other industrial processes. In turn, a lot of ethanol producers see carbon capture as a way to lower their greenhouse gas (GHG) emissions and help ensure their own long-term viability in a decarbonizing world while also reaping some of the benefits from the federal government’s 45Q tax credit for CO2 sequestration, which was significantly enhanced in last year’s Inflation Reduction Act (IRA).

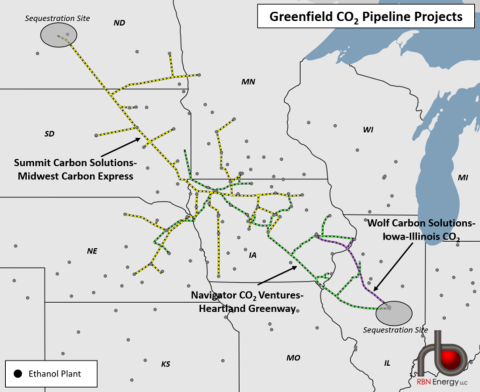

That was the strategy behind Heartland Greenway (dashed green line in Figure 1 below), a Navigator CO2 Ventures project that we first wrote about back a couple of years ago. It would have helped dozens of ethanol plants across five states (Illinois, Iowa, Minnesota, Nebraska and South Dakota) finance and construct their CO₂ capture equipment; transported the captured CO₂ over a newly built, 1,300-mile-plus pipeline network; and permanently sequestered up to 15 million metric tons per annum (MMtpa; 792 MMcf/d) of CO2 at a series of Class VI wells in south-central Illinois (gray oval at bottom right of Figure 1). But Navigator pulled the plug on Heartland Greenway in October in the face of public opposition, difficulties in acquiring the rights-of-way needed to build the pipeline, and the “unpredictable nature of the regulatory and government process involved.”

Figure 1. Canceled and Planned Greenfield CO2 Pipeline Projects. Source: RBN

Join Backstage Pass to Read Full Article