After a decade of regulatory and legal challenges, Mountain Valley Pipeline (MVP) finally came into service in the middle of last year. The 2-Bcf/d pipeline — soon to be expanded to 2.5 Bcf/d via additional compression — was designed to ease natural gas takeaway constraints out of the Marcellus/Utica and help production there break past its current plateau near 36 Bcf/d, but bottlenecks on the massive Transco Pipeline have complicated matters. In today’s RBN blog, we look at efforts to unleash more Appalachian gas in the domestic market, focusing on the Southside Reliability Enhancement Project (SREP), which has enabled more gas to reach North Carolina.

This is the fourth blog in our series about upstream and midstream developments in the Marcellu/Utica shale play. In Part 1, we discussed how the enormous production growth in the basin during the early years of the Shale Era stalled in the 2020s, averaging about 35 Bcf/d for the past five years. Appalachian production has been stymied not by challenges on the upstream side but by the lack of takeaway capacity in the region. Part 2 discussed the various projects — proposed, under construction and already in service — to expand pipeline takeaway capacity through new lines and expansions of existing lines. Part 3 turned to the individual upstream companies and their near-term production plans as communicated to investors.

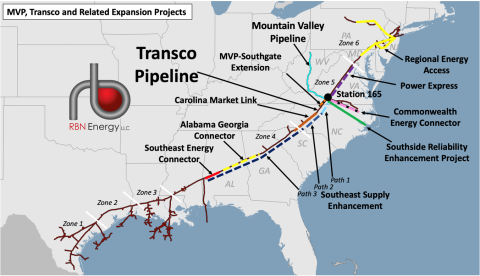

Today, we are going to dive more deeply into what was discussed in Part 1, focusing on what has been accomplished since SREP (area of improvements indicated by green line in Figure 1 below) came into service in September 2024, including how much incremental gas is flowing out of Appalachia and where it is heading. Let’s start with a look at how flows on MVP have developed now that it has been online for more than a year. MVP (aqua line) started flowing gas in June 2024 and ramped up its outflows into Transco to 1 Bcf/d within its first month of service. Some of that gas was finding new egress to markets to the south while some of it was displacing natural gas that previously flowed in from farther north (more on that below). After plateauing for a time last summer, MVP’s ramp-up resumed in the fall and early winter. By the beginning of 2025, MVP had reached its full potential, pouring an average of 1.9 Bcf/d into Transco, according to data from Wood Mackenzie. While those volumes sagged in subsequent months, the cause was related to natural gas prices rather than a constraint on MVP’s ability to find supply or flow its molecules to Transco. Next, let’s look at why it happens that way.

Figure 1. MVP, Transco and Related Expansion Projects. Source: RBN

Join Backstage Pass to Read Full Article