Marcellus/Utica natural gas production grew by leaps and bounds in the 2010s, but the pace of growth has slowed dramatically in recent years, mostly due to takeaway constraints. Finally, the prospects for renewed growth are improving. New pipeline capacity out of Appalachia is coming online — especially to the booming Southeast, and maybe the Gulf Coast too. New LNG export capacity is about to be commercialized. And a lot of new gas-fired generating capacity — much of it tied to planned data centers — is under development within (or very near) the Marcellus/Utica region. In today’s RBN blog, we examine the three big gas-demand drivers behind the shale play’s impending renewal.

As we said in Part 1, the Marcellus/Utica is by far the most prolific gas production area in the U.S., accounting for about one-third of the nation’s daily output. The shale play’s gas production soared from less than 2 Bcf/d to more than 33 Bcf/d over that decade, but its output through the first half of the 2020s has stayed close to flat, averaging about 35 Bcf/d over that period — ~24 Bcf/d from the NGL-rich “wet Marcellus/Utica” in southwestern Pennsylvania, northern West Virginia and eastern Ohio and ~11 Bcf/d from the “dry Marcellus” in northeastern Pennsylvania. (Note: Only about half the gas emerging from wells in the parts of the Marcellus/Utica that we generally refer to as “wet” includes significant volumes of NGLs; the other half is dry.)

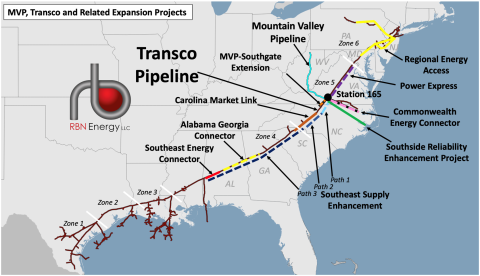

The primary hurdle to further growth has been takeaway capacity; there hasn’t been enough space on pipelines out of Appalachia to move more of the shale play’s gas to demand centers hundreds of miles away. That’s been changing, however, mostly due to the June 2024 startup of the 2-Bcf/d Mountain Valley Pipeline (MVP; aqua line in Figure 1 below) from northern West Virginia to Transco Station 165 in south-central Virginia and the advancement of several capacity-expansion projects on or near Transco itself. A few of these projects (Regional Energy Access, Southside Reliability Enhancement Project, Carolina Market Link, and Southeast Energy Connector) came online over the past 18 months, and others (Commonwealth Energy Connector, MVP Southgate, Southeast Supply Enhancement, and Alabama Georgia Connector) will follow later this year and in 2027-28. (See Part 1 for details.)

Figure 1. MVP, Transco and Related Expansion Projects. Source: RBN

Join Backstage Pass to Read Full Article