The boundaries of what we typically think of as the Haynesville Shale in Northeast Texas and Northwest Louisiana are expanding. E&Ps are increasingly moving out from the core producing acreage and exploring new frontiers, including the far western part of the dry-gas shale play. Wrangling gas from this prospect is challenging, with deeper, high-pressure reservoirs, temperatures up to 450°F and wells drilled to extreme depths of up to 19,000 feet. But with new technology, tenacity and a little bit of luck, it could be quite promising. In today’s RBN blog, Part 1 of a miniseries, we’ll discuss what’s happening in the far western part of the Haynesville.

Oil and gas exploration begins with geologists who utilize cutting-edge tech to identify promising locations — such as the Haynesville — that might hold large, recoverable volumes of hydrocarbons. Then, wildcatters rush in (see Never Try To Tame a Wildcatter) to sniff out the best, most lucrative locations. Using a lot of science and a little gut instinct, they start by drilling exploratory wells, with the results closely eyed to determine if it’s economical to drill production wells in that area. If the acreage is proven economic and becomes highly sought-after paydirt by other producers, a feeding frenzy often develops. Over time the most productive acreage can get drilled up and production there declines. So E&Ps are continually working to replace reserves, either through mergers and acquisitions or by finding and developing new areas. (See Steady, As She Goes for more on E&P strategies.)

That takes us to the Haynesville, where we see those same dynamics at play. Unlike some other major shale plays (most notably the Permian) where natural gas is produced as a byproduct of crude oil, drilling in the Haynesville is entirely gas-focused — meaning that revenues from gas sales, without significant uplift from liquids volumes, are expected to justify the cost of the well. The three biggest factors in determining whether drilling a new well is worth it are the costs to produce the hydrocarbons and get them to market, the volume of marketable products, and the price that those products will fetch. Generally speaking, Haynesville wells are deep (in the neighborhood of 10,500-13,500 feet compared to 4,000-8,000 feet in the Marcellus) and therefore expensive. But if and when natural gas prices are supportive, the tremendous volume of gas produced with each well justifies the cost. While cost and volume of a developed acreage position can be reasonably well predicted, that third factor — the expected price — becomes the key variable in producers’ drilling plans.

[To understand more about Gulf Coast natural gas pricing dynamics, RBN has released the Arrow Model, which ties together the myriad changes affecting supply-and-demand fundamentals in the Texas and Louisiana gas markets, including production, pipeline capacity and LNG exports. Click here to learn more.]

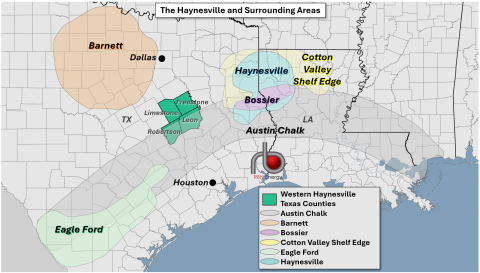

We have written extensively about the Haynesville Shale (see Say You’ll Be There, Don’t Call It A Comeback and, most recently, Sitting, Waiting, Wishing). The Haynesville, one of the OGs of shale development, burst onto the scene in 2008 during the early days of the Shale Revolution. The most popular areas of gas development in Louisiana have been Bossier, Caddo, DeSoto and Red River parishes. In Texas, Harrison and Panola counties have been the hot spots (blue-shaded area in Figure 1 below).

Figure 1. The Haynesville and Surrounding Areas. Source: RBN

Join Backstage Pass to Read Full Article